HFM (HotForex) Review 2023

Hotforex is a Low-cost forex broker that accepts Malaysian traders. They are regulated by multiple regulators, have multiple account types, Metatrader platform, but there are few cons. We have compared them in this Hotforex review.

HFM is an STP forex and CFD broker that accepts traders based in Malaysia. They provide their services in 27 different languages including English & Malay.

HFM offers seven different types of accounts for Malaysian traders which are: Islamic, Micro, Premium, Zero Spread, Auto, PAMM, and HFCopy. The fees that they charge depending on the type of account held by the trader. Users have the option of using the MetaTrader 4 or MetaTrader 5 trading platforms which are available on smartphones, computers, tablets, and web browsers.

HFM (HotForex) is incorporated in St. Vincent and Grenadine and is regulated by the FCA (UK) which is a tier-1 financial regulator, and FSCA among others. So, HFM (HotForex) is a relatively safe broker for forex trading.

HFM (HotForex) offers Malaysian traders the opportunity to trade 53 currency pairs, and 100+ CFDs on commodities, metals, energies, indices, shares, and more.

In this HFM (HotForex) Malaysia review, we’ve listed the pros and cons of this broker, along with their fees, safety, reputation, platforms, bonus & everything else you need to know before choosing them.

HFM (HotForex) Malaysia Pros

- HFM (HotForex) is a STP broker so there is no conflict of interest.

- They charge low fees overall without any hidden fees.

- HFM (HotForex) offers Negative Balance Protection to traders in Malaysia

- They are regulated by the Tier- 1 FCA (UK) Financial Authority, Tier-2 CySEC, FSCA, in addition to other reputable financial authorities. So trading with them is considered safe.

- They offer an Islamic account to Malaysian traders.

- They offer a wide variety of instruments to trade.

HFM (HotForex) Malaysia Cons

- HFM (HotForex) does not have a proprietary trading platform, they only offer MT4 & MT5.

- There is no local phone number for support in Malaysia.

HFM (HotForex) Malaysia – A quick look

| 👌 Our verdict on HFM (HotForex) | #2 Forex Broker in Malaysia |

| 🏦 Broker Name | HFM (HotForex) Malaysia |

| 💵 Typical EUR/USD Spread | 1.2 pips (with Standard Account) |

| 📅 Year Founded | 2010 |

| 🌐 Website | www.hfm.com |

| 💰 HFM (HotForex) Malayisa Minimum Deposit | $5 |

| ⚙️ Maximum Leverage | 1:1000 |

| ⚖️ HFM (HotForex) Regulations | FCA, DFSA, FSCA, FSA |

| 🛍️ Trading Instruments | 53 currency pairs, CFDs on 6 metals, 4 energies, several indices, more than 56 shares, 5 commodities, 12 cryptocurrencies, 3 bonds, and 34 ETFs |

| 📱 Trading Platforms | MT4, MT5 for desktop, tablet, web & mobile |

Is HFM (HotForex) Malaysia Safe?

As mentioned in the introduction, HFM (HotForex) is registered in St. Vincent and Grenadine with the registration number 22747 IBC 2015. And Malaysian traders are registered under this regulation.

HFM (HotForex) Group is regulated by one Tier-1 financial regulator, and 2 Tier-2 regulators, along with other reputed financial regulators. They have been in business for more than 10 years and have been having millions of registered traders around the globe over the years.

HFM (HotForex) is regulated and authorized under following regulators:

- HFM (HotForex) is registered with the Financial Conduct Authority (FCA) of the United Kingdom under name ‘HF Markets (UK) Ltd’ – with Firm Reference No. 801701

- HF Markets (Europe) Ltd is also regulated with CySEC under license number 183/12.

- HFM (HotForex) is registered and licensed by the Dubai Financial Services Authority (DFSA) under the name ‘HF Markets (DIFC) Ltd’ with license number F004885.

- HotForex is registered and licensed by the Financial Sector Conduct Authority (FSCA) of South Africa under the name ‘HF Markets SA (PTY) Ltd’ with license number 46632.

- HFM (HotForex) is registered and licensed by the Financial Services Authority (FSA) of Seychelles under the name ‘HF Markets (Seychelles) Ltd’ with license number SD015.

Is HotForex a safe forex broker for Malaysian traders? Yes, in our opinion HFM is a safe broker considering the fact that they are regulated with multiple Top-tier regulations.

In addition to being highly regulated, HFM also maintains other security practices such as segregation of funds, negative balance protection, and insurance against financial loss.

So, we consider HFM a safe broker for Malaysia-based traders.

HFM Malaysia Fees

The fees charged by HFM depends on a variety of factors. These factors include which account type is being used, which instruments are being traded, and when the trade is being made.

For this review, we use a few benchmark examples to give you an idea of how much fees they charge.

Here is a breakdown of trading & non-trading fees at HFM Malaysia:

- Variable Spread that is not that high – Six out of the seven account types offered by HFM are spread only. The minimum spread in all accounts starts with 1 pip except the Zero account which offers trades with no spread (But charges a commission). The average spread charged for the benchmark EURUSD currency pair is 1.2 pips.

- $7 Commission per Lot with Zero Spread Account – They do not charge any commission on trades under six out of the seven account types. But for the Zero account, commissions can start as low as USD 0.03 per 1000 lots. They have two commission structures for forex traders.

The first commission structure charges USD 0.03 per 1000 lots while the second commission structure charges USD 0.04 per 1000 lot. The commission structure depends on the currency pair that you are trading.

The Zero account is especially suitable for scalpers and high-volume traders.

- Zero Deposit and Withdrawal Fees – HFM does not charge any fees for making a deposit or a withdrawal. Additionally, HFM does not cover any service fees that may be charged by the trader’s chosen payments service provider.

- No Inactivity Fees – HFM does not charge any fees for inactivity. You may open an account with them and keep it dormant for as long as you want without incurring any charge.

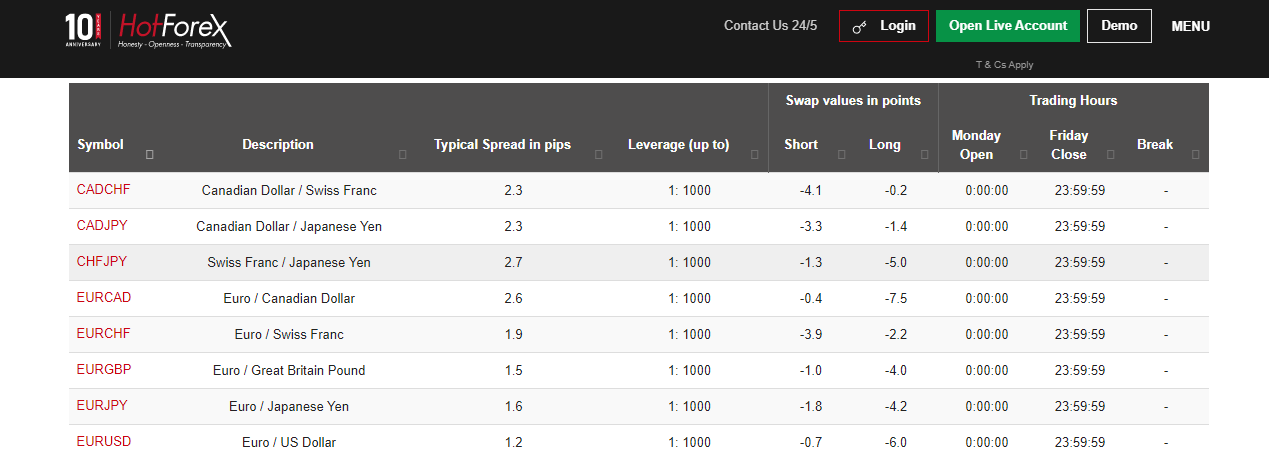

Below screenshot of table from their website shows the typical spread from their various accounts.

Overall, HFM is a low-cost broker. They usually charge tight spreads and no commission. They do not have any hidden fees, which makes them an attractive choice for traders.

HFM Bonus

HFM offers a variety of promotional bonuses for their traders. A trader may be eligible to claim the 100% super charged bonus, the 30% rescue bonus, or the 100% credit bonus.

- 100% Super Charged Bonus – The super charged bonus is available only for Premium and Islamic accounts. The super charged bonus is basically a deposit bonus which will double the amount of your deposit if it exceeds the deposited amount of USD 250.

- Rescue Bonus – The 30% rescue bonus is available on all types of accounts. The intention behind the bonus is to protect traders from drawdown periods. The maximum amount that can be claimed as a rescue bonus is USD 7000.

- 100% Credit Bonus – The 100% credit bonus only applies to micro, premium, and Islamic account types. This bonus can be withdrawn if the volume requirements are met. The time limit to avail this bonus is relaxed so that traders can take sound trading decisions.

HFM Deposit and Withdrawal

HFM offers a wide range of deposit and withdrawal methods for traders in Malaysia.

There is zero fees on deposits & withdrawals, which is a plus point.

Here is a list of the deposit options that are available at HFM Malaysia:

- No local bank transfer (Only Wire Transfer) – An unlimited amount of money can be deposited to your trading account through this method. It generally takes 2 – 7 days for the credited amount to reflect in your account. But HFM does not offer any local bank transfer option.

- Credit Cards – HFM accepts Union Pay, Maestro, Mastercard, and Visa credit cards. The maximum amount varies depending on the type of card. The amount usually reflects in your account within 10 minutes.

- Online Payment Options – HFM offers a variety of online payment options for Malaysian traders including Bitpay, Skrill, Neteller, Vload, WebMoney, and Crypto Payments. The maximum deposit amount varies from method to method.

The withdrawal methods are generally the same as your deposit method. And you can request your first withdrawal only with the method used for funding your account.

Overall, the deposit & withdrawal methods at HFM are similar to other brokers, except that they don’t offer local bank transfers. The good thing is that they don’t charge any deposit or withdrawal fees, which makes it a good option to open an account with them.

HFM Account Types

As mentioned earlier, HFM offers seven different types of accounts. Each type of account has its own pros and cons and is suitable for different types of traders. For example, the Zero Spread account is suitable for high-volume traders and scalpers.

HFM has a minimum deposit of $5, which is with their Micro Account. The exact minimum deposit depends on your account.

Here is our breakdown of the different account types as relevant to Malaysian traders.

1. Islamic Account – The Micro, Premium, Auto, and Zero spread accounts are available as Islamic accounts. The typical account conditions apply with the exception that they do not incur swap or rollover charges when holding a position overnight.

2. Micro Account – The minimum deposit for opening a Micro account is $5. The maximum leverage that can be availed is 1:1000.

3. Premium Account – The minimum deposit for opening a Micro account is $100. The maximum leverage that can be availed is 1:500.

4. Zero Spread Account – The minimum deposit for this account type is $200. The maximum leverage available is 1:500. This type of account charges very tight spreads which can be as low as zero. However, traders will need to pay a commission per trade.

5. Auto Account – The minimum deposit is $200. The maximum leverage is 1:500. The Auto account allows you to subscribe to free and paid trading signals from the MQL5 trading community.

6. PAMM Account – The minimum deposit is $250. The maximum leverage that can be used is 1:300.

7. HFCopy Account – The HFCopy account allows “followers” to copy the trades of “Strategy Providers”. The Strategy Providers can charge a performance fee that may be as high as 50%.

How to Open Account with HFM (HotForex)

Here are some steps to open an account with HotForex (HFM):

- Visit Website: Go to HotForex’s official website at www.hfm.com.

- Sign Up: Click on “Register” or “Open Live Account.”

- Choose Account Type: Select the type of account you want to open (e.g., Micro, Premium, Zero Spread).

- Fill Registration Form: Enter your personal details, including name, email, country, and other required information.

- Submit Application: Review your application, agree to the terms and conditions, and submit your account application.

After completing these steps and your account is approved, you can fund your account and start trading.

HFM Trading Instruments

HFM offers traders the option of trading more than 53 currency pairs, CFDs on 6 metals, 4 energies, several indices, more than 56 shares, 5 commodities, 12 cryptocurrencies, 3 bonds, and 34 ETFs.

Overall, they have a very wide selection of instruments compared to other similar forex brokers like OctaFX, and FXTM, which have much lower instruments. Although Exness has a higher number of currency pairs than Hotforx.

The good thing is that the availability of instruments is the same, regardless of the account type that a trader is using. This means, that you can trade the same instruments with a Micro account as with a Zero account.

The max. leverage that can be availed depends on the type of account that is being used and the instrument that is being traded.

HFM Trading Platforms

HFM is a Metatrader based forex & CFD broker.

Traders with HFM have the option of using either the MetaTrader 4 or the MetaTrader 5 trading platforms. Both these trading platforms are available on desktops, smartphones, tablets, and web browsers.

Users of both Windows and Mac OS can access these trading platforms. For mobile users, these trading platforms are available on both Android and iOS.

The MT4 and MT5 are highly popular trading platforms for forex traders and they are easy to use.

HFM does not offer its own proprietary trading platform for traders.

HFM Customer Support

Traders in Malaysia can contact the HFM customer support team through live chat, email, fax, phone call, or through a contact form available on their website. The customer support team is available 24 hours on all weekdays.

- Good Live Chat support: We used the live chat option while writing this review and found the responses to be quick and helpful. There was almost negligible wait time during connection, and the answers were quick.

- No Email Support in Malay: HFM does not offer email support in Malay. The email support is available in English, Chinese, and 3 other languages. Malaysian traders can also get in touch with them through a contact form available on HFM’s website.

- No Local Phone Number: HFM does not have a local Malaysian number that traders can call, however, traders can use a global phone number available on their website. The global number is toll-free.

Overall, HFM offers a variety of ways in which Malaysian traders can get in touch with them.

Do We Recommend HFM Malaysia?

In Short, yes we recommend HFM for traders based in Malaysia.

HFM is a low-cost broker that charges tight spreads and does not charge a commission in most of its account types. They do not charge any hidden fees in the form of deposit fees or otherwise.

HFM is regulated by a number of reputed financial regulators including the FCA of the UK, FSCA, CySEC. This makes them a safe choice.

They also have a wide variety of instruments that can be traded. They have also recently started offering ETFs for trading. Even though HFM does not have a proprietary trading platform, they offer the standard MT4 and MT5 trading platforms to users.

Further, they offer Islamic accounts as well.

The main drawback for Malaysian traders is that they do not offer a local phone number that can be called for customer support. The regional email support is also not available in Malay.

FAQs on HFM Review

What is the minimum deposit for HFM?

HFM have multiple payment methods for deposit. However, the minimum deposit starts from $5 with micro trading account without any charges on deposit.

How long does it take to withdraw from HFM?

Withdrawal requests submitted before 10:00 am server time are processed on the same business day between 7:00 am and 5:00 pm server time. If the withdrawal is submitted after 10:00 am server time, then it will be processed on second business day between 07:00 am and 17:00 pm server time.

How to withdraw from HFM?

As per HFM’s withdrawal Conditions, withdrawals are always made using the same payment method/gateway that was used to make the initial deposit.

HotForex Malaysia Kenya