IC Markets Review Malaysia 2023

IC Markets is a market-leading ECN broker for traders in Malaysia

IC Markets is an Australian ECN forex broker that started its operations in 2007. IC Markets accepts traders based in Malaysia. Their website is also available in Malay and they offer Islamic accounts.

IC Markets offers three types of accounts to traders which are Raw Spread, cTrader, and Standard accounts. Both the Raw Spread and Standard accounts can be converted into Islamic accounts. The company also offers a trial demo account for new users.

IC Markets is a well-regulated broker and holds a license to operate from the Tier-1 financial authority ASIC (Australia). The company is also regulated by the FSA of Seychelles and the CySEC of Cyprus. They implement segregation of funds so that client funds are kept safe and distinct from company funds.

They offer the MetaTrader 4, MetaTrader 5, and cTrader trading platforms to traders. Their trading platforms are available for desktops, smartphones, and tablets. Their trading platform can also be accessed directly through a web browser.

IC Markets offers a wide range of trading instruments to traders. They provide access to 60 currency pairs, 23 indices, over 19 commodities, more than 200 stocks, 6+ bonds, 4 global futures, and cryptocurrencies.

Our review will discuss all the various aspects of trading forex and CFDs with IC Markets for Malaysian traders. We will talk about the pros and cons compared to other similar brokers and provide our verdict.

IC Markets Malaysia Pros

- Their website is available in Malay.

- IC Markets offer MT4, MT5 as well as cTrader.

- IC Markets is regulated by Tier- 1 regulator ASIC (Australia), so it is considered a safe broker.

- Islamic account option is available.

- Crypto CFDs are available.

IC Markets Malaysia Cons

- No Negative Balance Protection is available.

- Local bank transfer option is missing for making a deposit.

- IC Markets does not have an office in Malaysia.

- No proprietary trading platform.

IC Markets Malaysia – A quick look

| 👌 Our verdict on IC Markets | #13 Forex Broker in Malaysia |

| 🏦 Broker Name | IC Markets Malaysia |

| 💵 Typical EUR/USD Spread | 0.1 pips (with Raw Spread Account) |

| 📅 Year Founded | 2007 |

| 🌐 Website | https://www.icmarkets.com/global/en |

| 💰 IC Markets Malaysia Minimum Deposit | $200 |

| ⚙️ Maximum Leverage | 1:500 |

| ⚖️ IC Markets Regulations | ASIC, FSA, CySEC |

| 🛍️ Trading Instruments | 60 currency pairs, CFDs on 23 indices, over 19 commodities, more than 200 stocks, 6+ bonds, 4 global futures, and cryptocurrencies. |

| 📱 Trading Platforms | MT4, MT5 for desktop, tablet, web & mobile along with cTrader. |

Is IC Markets Malaysia Regulated?

IC Markets has a long track record and has been operating since 2007. The company is also regulated by the ASIC of Australia which is a tier- 1 financial authority.

Group entities of IC Markets are licensed to operate by the following financial authorities:

- IC Markets is registered with the Australian Securities and Investment Commission (ASIC) of Australia under the name ‘International Capital Markets Pty Ltd’ and holds the Australian financial services licence (AFSL) No. 335692.

- IC Markets is registered with the Seychelles Financial Services Authority (FSA) under the name ‘Raw Trading Ltd’ and it holds the Securities Dealer Licence No SD018.

- IC Markets is registered with the Cyprus Securities and Exchange Commission (CySEC) under the name ‘IC Markets EU Ltd’ and has been provided the license number 362/18.

IC Markets is considered a safe broker for Malaysian traders in our opinion.

The company is regulated by reputed financial authorities in various countries, and they have a proven record over the years. They practice segregation of funds in order to ensure the safety of the money deposited by their clients.

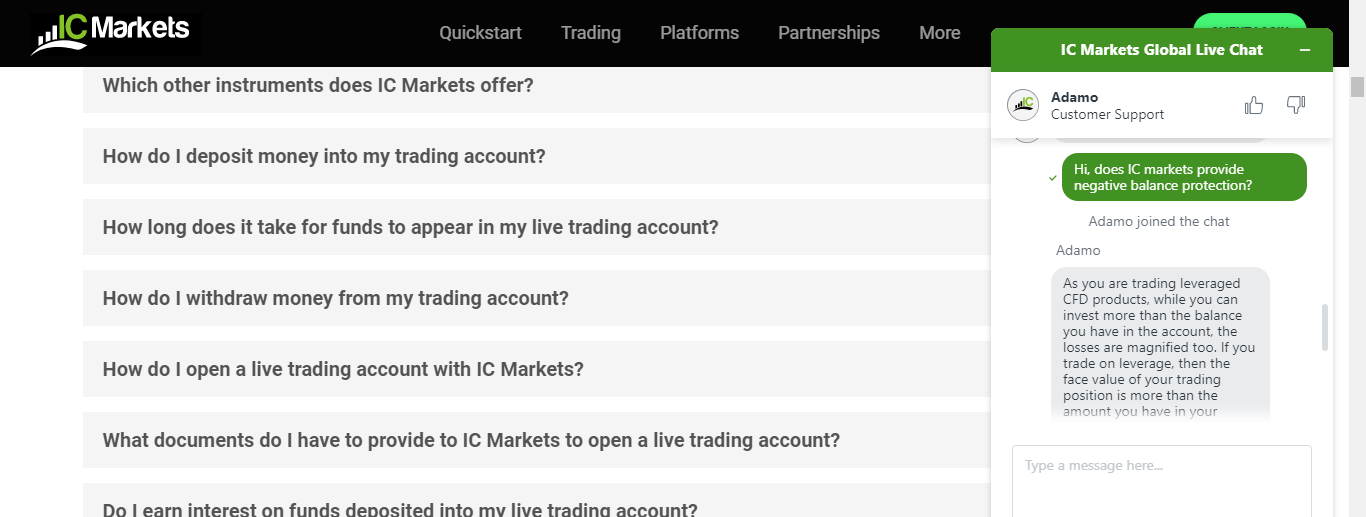

However, it is worth noting that IC Markets does not provide negative balance protection which means that a trader can lose more money than he has deposited.

Overall, we consider IC markets to be safe broker.

IC Markets Malaysia Fees

IC Markets charges fees in the form of spread and commissions. The exact fees charged depend upon a variety of factors.

Check out the breakdown of the fees charged by IC Markets.

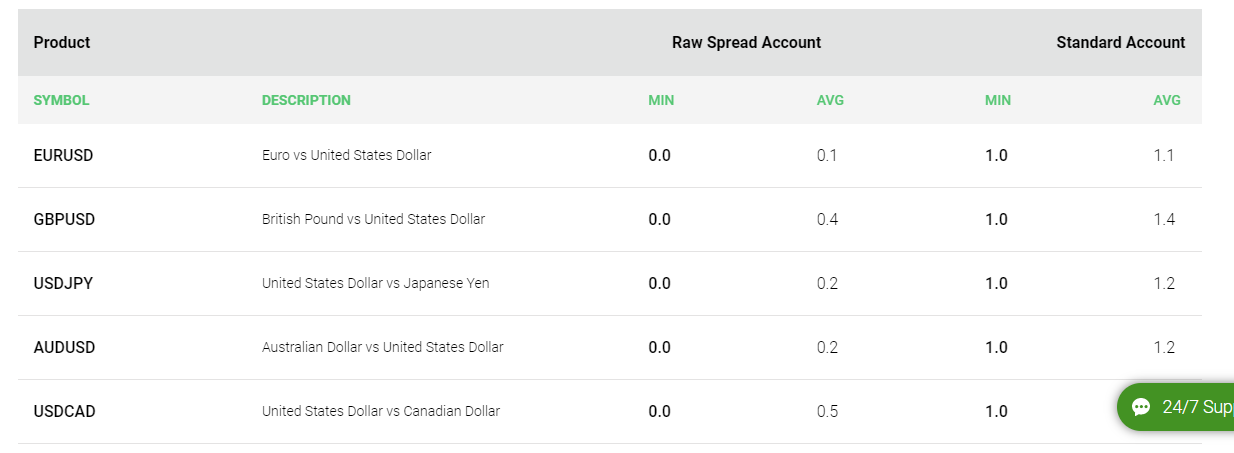

Variable Spread – IC Markets charges a variable spread that depends on the market conditions, the instrument being traded, and the account type. The minimum spread can go as low as 0 pips in case the conditions are right. The average spread incurred while trading the benchmark EURUSD currency pair through a Raw Spread account is 0.1 pips.

Below is a screenshot of the typical spread charged by IC Markets through their Raw Spread account for various currency pairs.

Commission under Raw Spread account – IC Markets does not charge a commission when trading with the Standard account. However, it does charge a commission for every trade when using the Raw Spread account. If the account holder is using the USD as a base currency, then the commission that will be charged is USD 7 per trade.

The spread that is charged under the Raw Spread account is lower compared to the Standard account.

Zero Deposit and Withdrawal Fees – IC Markets does not charge any deposit or withdrawal fees from its traders. However, traders may incur a fee from a payment gateway like Skrill for their services. IC Markets does not reimburse traders for such fees.

No Inactivity Fees – IC Markets does not charge any inactivity fees from its traders.

Overnight Swap Rates – IC Markets charges an overnight swap rate if a position is held by a trader overnight. The swap rates vary from currency to currency. The current swap rate chargeable for a long position on EURUSD is -4.40.

Overall, we consider IC Markets to be a low-cost broker. The spread that they charge is lower than average compared to other similar brokers. They do not charge a commission if trading with the Standard account. They also do not charge any hidden fees such as a deposit or withdrawal fee or an inactivity fee.

IC Markets Bonus

IC Markets is currently not offering any promotions or bonuses. This is unlike most comparable forex brokers who usually have multiple promotional offers for traders.

IC Markets Deposit and Withdrawal

IC Markets offers a wide variety of ways in which a trader can make a deposit or a withdrawal. It should be remembered that IC Markets does not charge a fee for making a deposit or a withdrawal, however, a fee may be charged by the payment service provider.

Here are the various ways in which traders can deposit their funds to an IC Markets account.

Credit and Debit Cards – A trader from Malaysia can deposit funds using their debit or credit card. They accept Visa and Mastercard issued cards. The time taken to process such as deposit is instantaneous.

PayPal – Traders can deposit their funds through PayPal, which is a popular international and domestic payment service provider.

Wire Transfer – A payment can be made through a bank wire transfer. It may take between 2 to 5 business days for the payment to reflect in your account.

Payment Wallets – Payment wallets that are accepted include Neteller, Skrill, UnionPay, BPay, FasaPay, POLI, and more.

It should be noted that IC Markets does not accept funds through local bank transfers.

IC Markets Account Types

IC Markets offers two types of accounts for traders using MT 4 or MT 5. These are the Standard account and Raw Spread account. For traders using the cTrader trading platform, the cTrader Raw Spread account is available. The Standard and Raw Spread accounts can be converted into Islamic accounts.

Here is a breakdown of the different account types available at IC Markets.

Islamic Accounts – Islamic accounts, also known as swap-free accounts, are available to traders of the Islamic faith. These accounts do not charge any overnight swap rates or rollover interest. However, IC Markets does not offer a completely free rollover feature.

They charge a flat financing charge per lot for the positions that are held overnight. For example, a trader holding an overnight position in the AUDSGD currency pair will be charged a flat rate of $5 per lot.

Traders can request the IC Markets customer support team to convert their account into an Islamic account.

Standard Account – No commission is charged from users trading through the Standard account, however, the spread may be higher. The minimum spread that is charged is 1 pip. The leverage offered is up to 1:500. This account is available on both the MetaTrader 4 and MetaTrader 5 trading platforms.

Raw Spread Account – The lowest spreads can be found through the Raw Spread account, however, traders are also charged a commission per trade. The spread starts from 0 pips. This type of account is available for those using the MT4 or MT5 trading platforms. Traders can use maximum leverage of 1:500.

cTrader Raw Spread Account – As the name suggests, the cTrader Raw Spread account is only available on the cTrader trading platform. This account type also offers highly tight spreads but also charges a commission. Scalping is available. The leverage can be up to a maximum of 1:500.

How to Open Account with IC Markets

Here are basic points for opening an account with IC Markets:

- Visit Website: Go to IC Markets’ official website at www.icmarkets.com.

- Sign Up: Click on “Open Live Account” or “Create Account.”

- Choose Account Type: Select the type of account you want to open (e.g., Raw Spread, Standard, Islamic).

- Fill Registration Form: Enter your personal details, including name, email, country, and other required information.

- Submit Application: Review your application, agree to the terms and conditions, and submit your account application.

Once your account is approved, you need to fund your account and start trading.

IC Trader Trading Instruments

The selection of trading instruments available at IC Markets is high compared to other similar forex brokers. Traders can choose from 60 currency pairs, 23 indices, over 19 commodities, more than 200 stocks, 6+ bonds, 4 global futures, and cryptocurrencies.

It should be noted that they also offer cryptocurrencies, which may not be an option available with every forex broker.

IC Markets Trading Platforms

IC Markets offers three different trading platforms for traders to choose from.

MetaTrader 4 – The MetaTrader 4 is one of the most popular trading platforms available in the market. This trading platform is easy to use and has several customizable features. It also has advanced technical indicators and fast order execution. Traders can use this platform on their desktops (Both Windows and Mac), smartphones (both android and iOS), tablets, as well as web browsers.

MetaTrader 5 – The MetaTrader 5 is the latest version of the MetaTrader trading platform. It has more advanced trading features when compared to the MT4. The MetaTrader 5 is also available on a wide variety of devices similar to the MT4.

cTrader – The cTrader is a trading platform that has been specifically designed for forex trading. The cTrader offers fast execution speeds and is supported on a variety of devices (including web browsers and smartphones). The cTrader also comes with a Smart Stop Out feature that helps with risk management.

Traders should note that IC Markets does not offer its own proprietary trading platform, however, they do offer a range of popular platforms.

IC Markets Customer Support

Traders in Malaysia can get in touch with the IC Markets customer support team in a variety of ways. They also have an extensive FAQs section that answers most queries that a trader might have before starting to trade through IC Markets.

Toll-free Dedicated Malaysian Phone Number – IC Markets offers a dedicated phone line through which Malaysian traders can contact them. This phone number is toll-free hence the trader will not have to incur any charge for the call.

24/7 Live Chat – The IC Markets website has customer support live chat box that is available at all times. We tested the live chat option while writing this review and found that they responded within a couple of minutes. The response was also quite helpful.

A screenshot of our chat with their customer support executive can be found below.

E-mail – Traders can email the various teams at IC Markets to resolve their queries and issues. Dedicated email addresses are available for client relations, support, accounts, and marketing.

Do We Recommend IC Markets Malaysia?

In short, yes we do recommend IC Markets for Malaysian traders because they are reputed CFD brokers & also well regulated.

IC Markets offers a wide variety of trading instruments to their traders. Their website is available in Malay and they offer Islamic accounts. They are a well-regulated broker that is licensed by a tier-1 financial authority (ASIC). The overall fees that they charge are lower than average when compared to other similar brokers.

The primary drawback to trading through IC Markets is that they do not have a local bank transfer option for making deposits.

Overall, we consider IC Markets to be a solid and safe broker for traders in Malaysia.

FAQs on IC Markets Review

How safe is IC Markets?

Yes. Your trading with IC Markets is totally safe. The IC Markets is regulated with multiple top tier regulatories like ASIC, CySEC, FSA and client’s funds are held in segregated account. Therefore your trading and funds are always safe.

What is the minimum deposit for IC Markets?

The minimum deposit for IC Markets is $200 with IC Markets standard account. And there are no charges for depositing funds with IC Markets

How to withdraw money from IC Markets?

Funds Withdrawal process is very simple. You can withdraw funds by submitting the withdrawal request from the client panel. Funds withdrawal requests will be processed within 24 hours and amount will take 2 to 5 bussiness days.

IC Markets Kenya