AvaTrade Malaysia Review 2023

Avatrade is a reputed fixed spread market maker forex broker. Their spread is very low, and they are well regulated. But should you choose them?

Avatrade is a market maker forex and CFD broker. It was founded in 2006 and is one of the lowest fixed spread CFD brokers for retail clients. They accept clients from Malaysia and their website and customer support are available in Malay. Avatrade claims to cater to more than 300,000 traders worldwide and processes more than 3 million trades every month.

Avatrade is a highly regulated broker and is licensed by multiple financial regulators around the world. Avatrade is licensed by a tier-1 financial regulator which is the ASIC of Australia. Additionally, Avatrade is regulated by the authorities of Ireland, Poland, the British Virgin Islands, Japan, South Africa, and the UAE.

They also offer Islamic accounts to traders in Malaysia. Avatrade offers two primary types of accounts: Retail and Professional. Both these types of accounts can be converted into Islamic accounts upon requesting customer support. They also offer a demo account where traders can test their strategies.

Avatrade offers several different trading platforms to their traders. These include the MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, AvaOptions, AvaTradeGO, automated trading platforms, and Mac Trading.

Overall, Avatrade offers more than 250 trading instruments which include more than 60 currency pairs, cryptocurrencies, major stock indices, commodities (including gold, silver, sugar, coffee), ETFs, individual shares, and bonds.

In this Avatrade review, we will discuss everything you need to know about Avatrade before trading with them. We will cover the pros and cons, fees, trading platforms, accounts, trading instruments, customer support, and more.

Avatrade Malaysia Pros

- They offer a dedicated website for Malaysian traders and customer support in all formats is available in Malay.

- They offer MT4, MT5 and their own proprietary trading platforms.

- Avatrade offers Negative Balance Protection to traders in Malaysia

- They are regulated by the Tier- 1 ASIC (Australia) Financial Authority, in addition to other reputable financial authorities. Hence, it is considered safe to trade through them.

- They offer an Islamic account to Malaysian traders.

- They offer cryptocurrencies to trade, however, cryptocurrencies are not available for Islamic accounts.

Avatrade Malaysia Cons

- Avatrade is a market maker.

- They charge a high inactivity fee.

- They do not have an office in Malaysia.

- They have relatively limited deposit and withdrawal options.

Avatrade Malaysia – A quick look

| 👌 Our verdict on Avatrade | #8 Forex Broker in Malaysia |

| 🏦 Broker Name | Avatrade Malaysia |

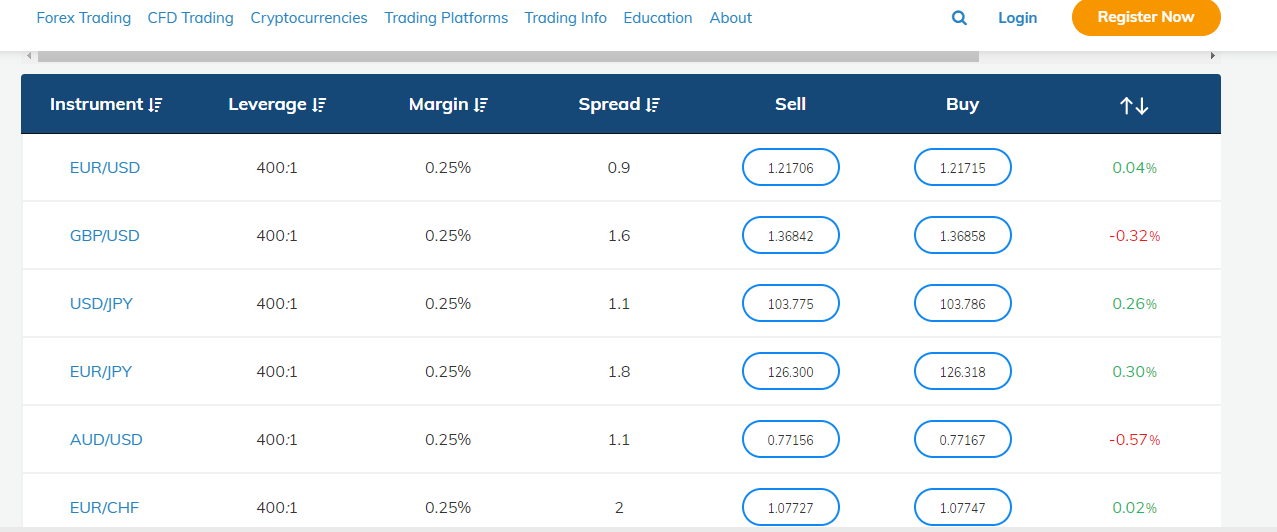

| 💵 Typical EUR/USD Spread | 0.9 pips (with Retail Account) |

| 📅 Year Founded | 2006 |

| 🌐 Website | https://www.avatrade.com.my/ |

| 💰 Avatrade Malaysia Minimum Deposit | $100 |

| ⚙️ Maximum Leverage | 1:400 for EURUSD |

| ⚖️ Avatrade Regulations | ASIC, CBI, PFSA, FSC, FSA, FSCA, FRSA |

| 🛍️ Trading Instruments | 60+ currency pairs, cryptocurrencies, major stock indices, commodities (including gold, silver, sugar, coffee), ETFs, individual shares and bonds |

| 📱 Trading Platforms | MT4, MT5 for desktop, tablet, web & mobile along with proprietary trading platforms. |

Is Avatrade Malaysia Regulated?

Avatrade has been in operation since 2006 and has a strong track record. It is regulated by a tier-1 financial authority which is the ASIC of Australia.

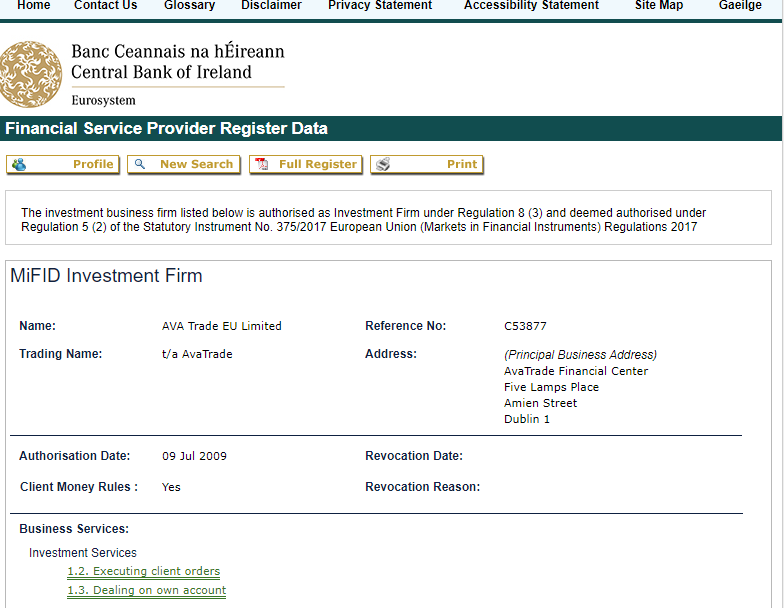

Avatrade is regulated and licensed by the following financial authorities:

- Avatrade is registered with the Central Bank of Ireland under the name ‘AVA Trade EU Ltd.’ – and holds the license number C53877

- Avatrade is registered with the Polish Financial Supervision Authority of Poland under the name ‘AVA Trade EU Ltd’

- Avatrade is registered and licensed by the Financial Sector Development Authority (FSCA) of South Africa under the name ‘Ava Capital Markets Pty’ and holds the license FSCA no. 45984

- Avatrade is registered and licensed by the Australian Securities and Investment Commission (ASIC) of Australia under the name ‘Ava Capital Markets Australia Pty Ltd’ and holds the license no. 406684

- Avatrade is registered and licensed by the British Virgin Islands Financial Services Commission under the name ‘Ava Trade Ltd’ and holds the license number SIBA/L/13/1049

- Avatrade is registered and licensed by the Financial Services Agency (FSA) of Japan under the name ‘Ava Trade Japan K.K.’ and holds the license number 1662.

- Avatrade is registered and licensed by the Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) of United Arab Emirates under the name ‘Ava Trade Middle East Ltd’ and holds the license number 190018

Is Avatrade a safe broker for Malaysian traders? Yes, we consider Avatrade to be a safe broker.

In addition to being highly regulated, Avatrade has a solid reputation. Avatrade also offers negative balance protection. All funds deposited by clients are kept in separate bank accounts for security.

Hence, we consider Avatrade to be a safe broker for Malaysian traders.

Avatrade Malaysia Fees

Avatrade’s fees depend on a number of factors including the timing of the trade, the instrument being traded, and the type of account held by the trader.

Hence, to give traders an idea of the kind of fees that are charged, we will be using certain benchmark examples.

Here is a breakdown of trading & non-trading fees at Avatrade Malaysia

- Average Floating Spread – Avatrade charges a variable spread that depends on the timing of the trade. The spread will also vary depending on the type of instrument being traded and the type of account being used.

For example, an average spread of 0.9 pips is charged for trading the benchmark currency pair EURUSD while using a retail account. A typical spread of 0.6 pips is charged when trading the same instrument using a professional account.

- No Commission – Avatrade does not charge a commission from traders using the retail or the professional account.

- No Deposit and Withdrawal Fees– Avatrade does not charge any fees for making a deposit of funds or a withdrawal. However, the payment service provider may charge a fee or commission for every transaction.

- Inactivity Fee after 3 Months – Avatrade charges an inactivity fee if an account is not used for a period of more than 3 months. An inactivity fee of $50 will be charged for every three months when the account is dormant.

Here is a screenshot of the spread charged for various currency pairs at Avatrade.

Overall, we found Avatrade to be a medium-cost broker. They do not charge a commission and they do not charge any deposit or withdrawal fees. Their spreads are average compared to other similar brokers. They do charge a high inactivity fee which traders need to be careful of.

Avatrade Bonus

Avatrade offers certain bonuses and promotions from time to time in order to make their service more attractive to traders.

Welcome Bonus – Avatrade currently offers a welcome bonus to new traders. While making a deposit, traders can claim a new deposit bonus of 20%. For example, if a trader deposits $1000 into their trading account, they can claim a bonus of $200.

Refer a Friend – Avatrade offers a referral bonus for every friend that you refer to Avatrade. The amount of the bonus depends on the amount that your friend deposits into their trading account. A higher first deposit will mean a higher bonus for you. The maximum bonus that you can get is $250.

For example, if you refer a friend to join Avatrade and they deposit $2000 into their trading account, then you will get an award of $50.

Avatrade Deposit and Withdrawal

The deposit and withdrawal methods offered by Avatrade differ from region to region. Traders in Malaysia can deposit their funds through credit cards or wire transfers. They also accept payments through certain e-wallets such as Skrill, WebMoney, and Neteller.

While making your first deposit with Avatrade, you will be asked to show certain verification documents. This may include proof of address and proof of identity. These regulations are in place to avoid fraud and money laundering.

The withdrawal process at Avatrade typically takes one to two business days. A withdrawal can only be made through the payment method that was used to make a deposit. However, a withdrawal through a different payment method can be made once 200% of the initial deposit has been withdrawn.

Traders should remember that Avatrade does not charge a deposit or withdrawal fee. However, a commission or fee may be charged by your payment service provider or bank.

Avatrade Account Types

Avatrade offers two primary account types to traders. These are the retail accounts and professional accounts.

Both retail and professional accounts can be converted into Islamic accounts.

Here is the primary difference between each type of account offered by Avatrade.

Islamic Accounts – Avatrade offers traders the option to convert their trading account into an Islamic account. To convert an account into an Islamic account, traders will need to make an application to the customer support team at Avatrade. Requests for conversion are usually processed within two business days.

Under an Islamic account, traders will not be charged a rollover fee when they hold a position overnight.

Cryptocurrencies cannot be traded through an Islamic account.

Retail Account – This is the account that is offered to every new trader who signs up with Avatrade. The retail account can be converted into an Islamic account or a Professional account. The minimum deposit to open such an account is $100. Users are offered different kinds of leverages for different instruments.

Professional Account – Not every trader can open a professional trading account with Avatrade. Traders will need to fulfill at least two out of three criteria to be eligible.

The three criteria are:

- Sufficient trading activity for a period of more than 12 months.

- Relevant experience in the financial services sector

- Financial instrument portfolio of more than 500,000 euros.

The fees charged under a professional trading account may be lower than a retail account. For example, the average spread for trading EURUSD is 0.6 pips under a professional account while it is 0.9 pips under a retail account.

How to Open Account with AvaTrade

To open a trading account with AvaTrade require following steps:

- Visit AvaTrade’s website.

- Choose an account type.

- Fill out the application with your details.

- Provide verification documents.

- Deposit funds and start trading upon approval.

Avatrade Trading Instruments

Avatrade offers traders the option to trade more than 250 instruments. Overall, they offer more than 60 currency pairs, commodities (including gold, silver, sugar, coffee), major stock indices, ETFs, cryptocurrencies, individual shares, and bonds.

We consider the variety of instruments offered by Avatrade to be average when compared to other similar brokers. It is worthwhile to note that they offer cryptocurrencies, however, cryptocurrencies cannot be traded through an Islamic account.

Avatrade Trading Platforms

Avatrade offers a wide range of trading platforms for traders to choose from.

MetaTrader 4 – The MetaTrader 4 (MT4) is a highly popular trading platform offered by most forex and CFD brokers. The MetaTrader 4 is highly customizable and feature-rich. It offers advanced technical analysis capabilities and quick order execution. The MetaTrader 4 is available on web browsers, desktops, smartphones, and tablets.

MetaTrader 5 – The MetaTrader 5 (MT5) is the later version of the MetaTrader 4. Compared to the MT4, MetaTrader 5 can support advanced trading for a wider selection of asset classes. It also offers a greater number of indicators when compared to the benchmark MT4.

WebTrader – The WebTrader is a proprietary trading platform offered by Avatrade. There is no need to download any software. It can be used straight from any web browser. It has an intuitive user interface and has a streamlined design.

AvaOptions – AvaOptions is a proprietary trading platform offered by Avatrade for options traders. It offers multiple controls that allow you to manage options trading with any combination of call and put orders. The platform is available on mobile devices as well as desktops. The main features of this platform include interactive risk management, a fully customizable interface, and a money manager.

AvaTradeGO – AvaTradeGO allows users to trade through their smartphones. It offers a feature-rich environment that is especially suitable for mobile use. It is available on both Android and iOS. You also have the option of using AvaProtect to manage your risk.

Automated Trading Platforms – Through automated trading platforms, traders can copy the trades made by other traders. The automated trading platforms offered by Avatrade are DupliTrade, ZuluTrade, and MQL5 – Signals Service.

Mac Trading – AvaTrader offers trading platforms specially designed for Mac users. The platforms available include the MetaTrader 4 Mac platform and Mac Online Trading. Users can also access these platforms through their iPhones or iPads.

Avatrade Customer Support

Malaysian traders have the option of reaching Avatrade’s customer support team in a variety of ways. Users can reach out to customer support through live chat, email, or phone calls. All of Avatrade’s customer support options are available in Malay.

Live Chat – The live chat option is available on their website. The option is open at all hours on weekdays but closed on weekends.

Email – Malaysian traders can access a dedicated email ID to resolve their queries and doubts.

Phone Call – Avatrade offers a local Malaysian number that can be called for customer support. This phone line is available all weekdays between 8 AM to 11 PM.

Do We Recommend Avatrade Malaysia?

Yes, we recommend Avatrade for Malaysian traders. They have a dedicated website for Malaysian traders which is in Malay. Their customer support is also available in Malay in all formats. They offer Islamic accounts for Malaysian traders.

They are a highly regulated global broker and are also regulated by the tier- 1 financial authority ASIC. They offer negative balance protection and segregation of funds. They offer a wide variety of trading platforms including proprietary trading platforms. Users can also trade cryptocurrencies with them.

The primary drawback to trading with Avatrade is that their deposit and withdrawal options are limited compared to other brokers. They also charge a high inactivity fee every three months.

Overall, we think Avatrade is a good all-rounder. They score well in most metrics in which we’ve measured their services.

FAQs on AvaTrade Review

What is the AvaTrade minimum deposit to start trading?

The minimum deposit for AvaTrade $100 and its depends upon your base currency and the payment method that you will choose. If base currency is USD or EUR then you can start trading with $100 or €100.

How to withdraw money from AvaTrade?

Funds withdrawal request can be sumbitted from MyAva section. Clients can withdraw to the same payment method that used for the deposit. AvaTrade process all withdrawal request within 1-2 working days.

Is AvaTrade Regulated in Malaysia

AvaTrade lacks regulation from the Malaysian authority, yet it holds regulation from other governing bodies like FSCA, ASIC, FSA, CySEC. And due traders are trading with AvaTrade at your own risk

How do I fund my Avatrade account?

You can add the funds in your account using credit/debits cards and E-Wallets Skrill, Webmoney, Neteller. Clients can also use wire transfer which take 1 to 5 days depending upon your region.

Avatrade Kenya