FBS Malaysia Review 2023

FBS is a CySEC regulated forex broker that accepts traders from Malaysia under IFSC regulation. Their fees is okay, support is fair, but we find them to be less safe. Read our full review to see why.

FBS is international STP forex and CFD broker that caters to traders based in Malaysia. FBS was founded in 2009 and has clients in more than 190 countries across the world. The company has won several awards for its services including The Best Broker in Malaysia at the Traders Fair & Gala Night in 2019.

FBS gives traders the option of choosing between five different types of accounts: Standard, Cent, Micro, Zero Spread, and ECN. Malaysian traders can also convert any of these accounts into swap-free Islamic accounts. However, the swap-free option is not available for trading CFD instruments. Their fee depends on the type of account that the trader holds and other factors such as the instrument being traded.

FBS offers traders the option of using MetaTrader 4, MetaTrader 5, or their proprietary FBS Trader trading platform. These trading platforms are available on desktops, smartphones, tablets, and web browsers.

FBS is headquartered in Russia, however, they are regulated by the IFSC in Belize. Through FBS, Malaysian traders have the option of trading 28 currency pairs along with CFDs on indices, commodities, metals, and stocks.

In this FBS Malaysia review, we discuss everything a trader needs to know including the pros and cons, fees, trading platforms, regulation, customer support, and more.

FBS Malaysia Pros

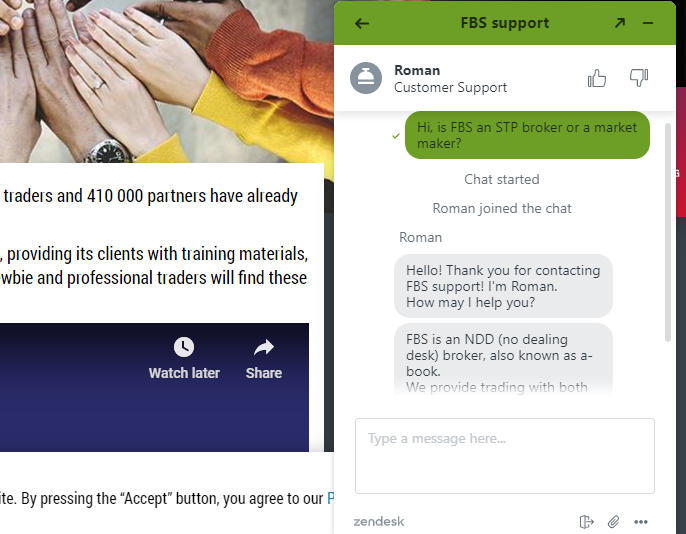

- FBS is an STP Broker which means that there is no conflict of interest.

- FBS offers Negative Balance Protection to traders in Malaysia.

- They offer an Islamic account to Malaysian traders.

- Their website is available in the local language for Malaysian traders.

- They offer a proprietary mobile trading platform.

FBS Malaysia Cons

- They do not offer a wide variety of instruments compared to other similar brokers.

- They charge a deposit and withdrawal fee.

FBS Malaysia – A quick look

| 👌 Our verdict on FBS | #4 Forex Broker in Malaysia |

| 🏦 Broker Name | FBS Malaysia |

| 💵 Typical EUR/USD Spread | 1.1 pips (with Standard Account) |

| 📅 Year Founded | 2009 |

| 🌐 Website | https://fbsmy.com/ |

| 💰 FBS Malaysia Minimum Deposit | $1 |

| ⚙️ Maximum Leverage | 1:3000 |

| ⚖️ FBS Regulations | CySEC, IFSC |

| 🛍️ Trading Instruments | 28 currency pairs, 4 index CFDs, 2 commodity CFDs, 4 metal CFDs, several stock CFDs, 9 exotic currency pairs |

| 📱 Trading Platforms | MT4, MT5 for desktop, tablet, web & mobile, FBS Trader for Mobile |

Is FBS Malaysia Regulated?

The Malaysian website of FBS is operated by the company under name FBS Markets Inc. The company is registered in Belize and headquartered in Russia. FBS started its operations in 2009 and have catered to more than 16 million traders since then.

FBS is regulated and licensed by the following financial authorities:

- FBS is registered with the International Financial Services Commission (IFSC) of Belize under the name ‘FBS Markets Inc’ – and holds the license number IFSC/000102/124

- A group company of FBS is registered with the Cyprus Securities and Exchange Commission (CySEC) under the name ‘Tradestone Ltd’ and holds the license number 331/17.

FBS is considered a moderate risk forex broker for Malaysian traders as they are not regulated in Malaysia. Traders from Malaysia are trading with FBS at their own risk, and are registered under offshore regulation.

Note that in addition to being regulated by CySEC (Tier-2), FBS has been operating since 2009, so this can be considered an important factor of trust.

Further, FBS also provides negative balance protection and keeps its funds with reliable banks and financial institutions. Hence, we consider FBS to be a safe broker for Malaysian traders.

FBS Malaysia Fees

FBS is a spread broker with an option for variable spread or fixed spread depending on your type of account. Certain FBS account types also charge a commission.

The fees charged by FBS Malaysia depend on the instrument being traded, the type of account held by the trader, and when the trade is being made.

We will use a few benchmark examples to judge how much fees FBS charges.

Here is a breakdown of trading & non-trading fees at FBS Malaysia:

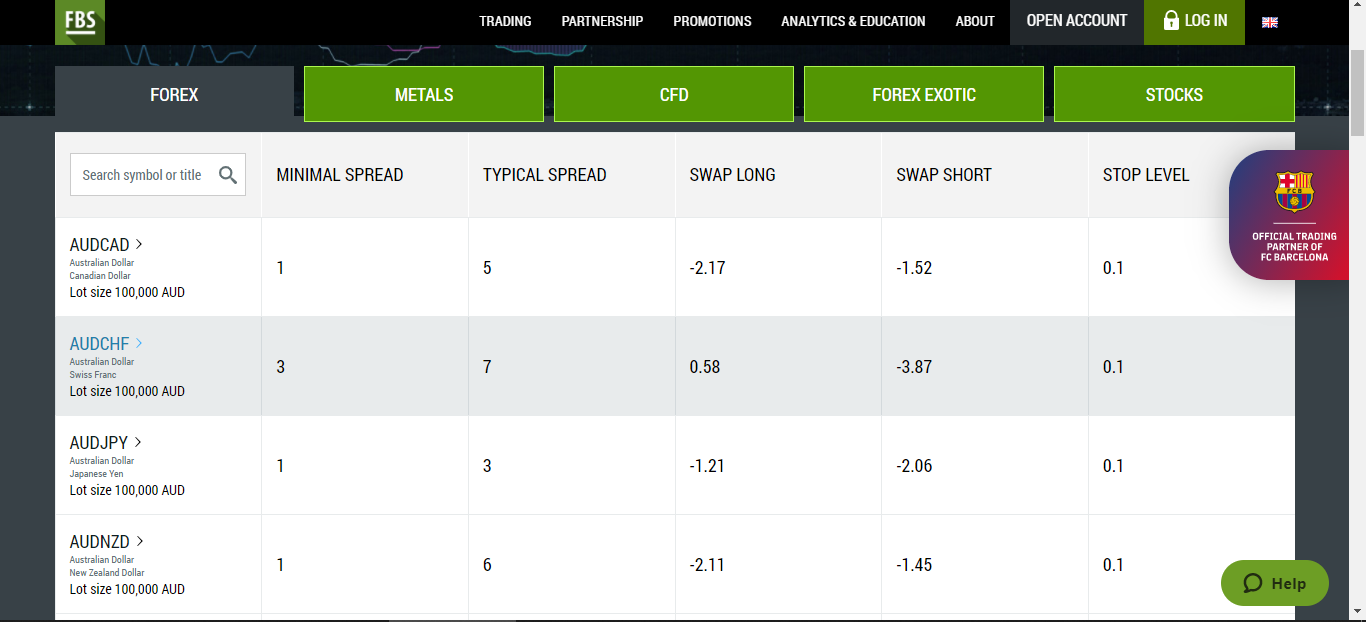

- Different Types of Spread – FBS offers different types of spreads to its users depending on the account type. Traders can choose to trade with variable spread starting from 0.2 pips, fixed spread starting from 0.3 pips, and can also choose to trade without a spread.

Under the Standard account, the typical spread for the benchmark currency pair of EURUSD is 1.1 pips.

- Variable or Fixed Commission – FBS does not charge any commission under the Micro, Standard, and Cent accounts. However, it does charge a commission under the Zero Spread and ECN Accounts.

Under the Zero Spread account, FBS charges a variable commission starting from $20 per lot. However, no spread is charged under this type of account.

Under the ECN account, FBS charges a fixed commission of $6. Under the ECN account, you are also charged a variable spread starting from -1 pip.

- Deposit and Withdrawal Fee– FBS does charge a deposit and withdrawal fee. The exact fee charged depends on the mode by which the deposit or withdrawal has been made.

- No Inactivity Fee – FBS does not charge an inactivity fee. A trader can keep his account dormant for as long as he likes without incurring a charge.

Here is a screenshot of the typical spread charged for various currency pairs with the Standard account at FBS.

Overall, we consider FBS to be a medium-cost broker. The spread and commission that they charge are similar to other comparable brokers. They charge a deposit and withdrawal fee which makes it more expensive to use them as a broker.

FBS Bonus

FBS runs a large number of promotional schemes and offers at all times. Here is a breakdown of some of their promotional offers available at this time.

100% Deposit Bonus – Traders can claim a 100% deposit bonus. Traders can apply for one bonus per deposit. To withdraw the bonus amount, a trader needs to trade the required lot volume.

Leverage 1:3000 – This bonus is available only to traders using the Standard and Zero Spread accounts. This bonus allows you to trade with a leverage of 1:3000. This means that you can deposit $10 and trade as if you are using $30,000. Remember that trading with more leverage also means that the risk is higher.

Cashback – Under this bonus, traders can get a cashback of up to $15 per lot that has been traded. You can also get a cashback if the lot that you have traded has lost money. This bonus is available for every traded lot.

Get Car from FBS – This bonus allows participants the chance to win a car. This bonus is active intermittently, so traders should watch out for it.

Quick Start Bonus – You can claim a bonus amount of $100 in your trading account on FBS trader. After you have claimed the amount, you will need to follow certain steps to be able to withdraw the money.

FBS Deposit and Withdrawal

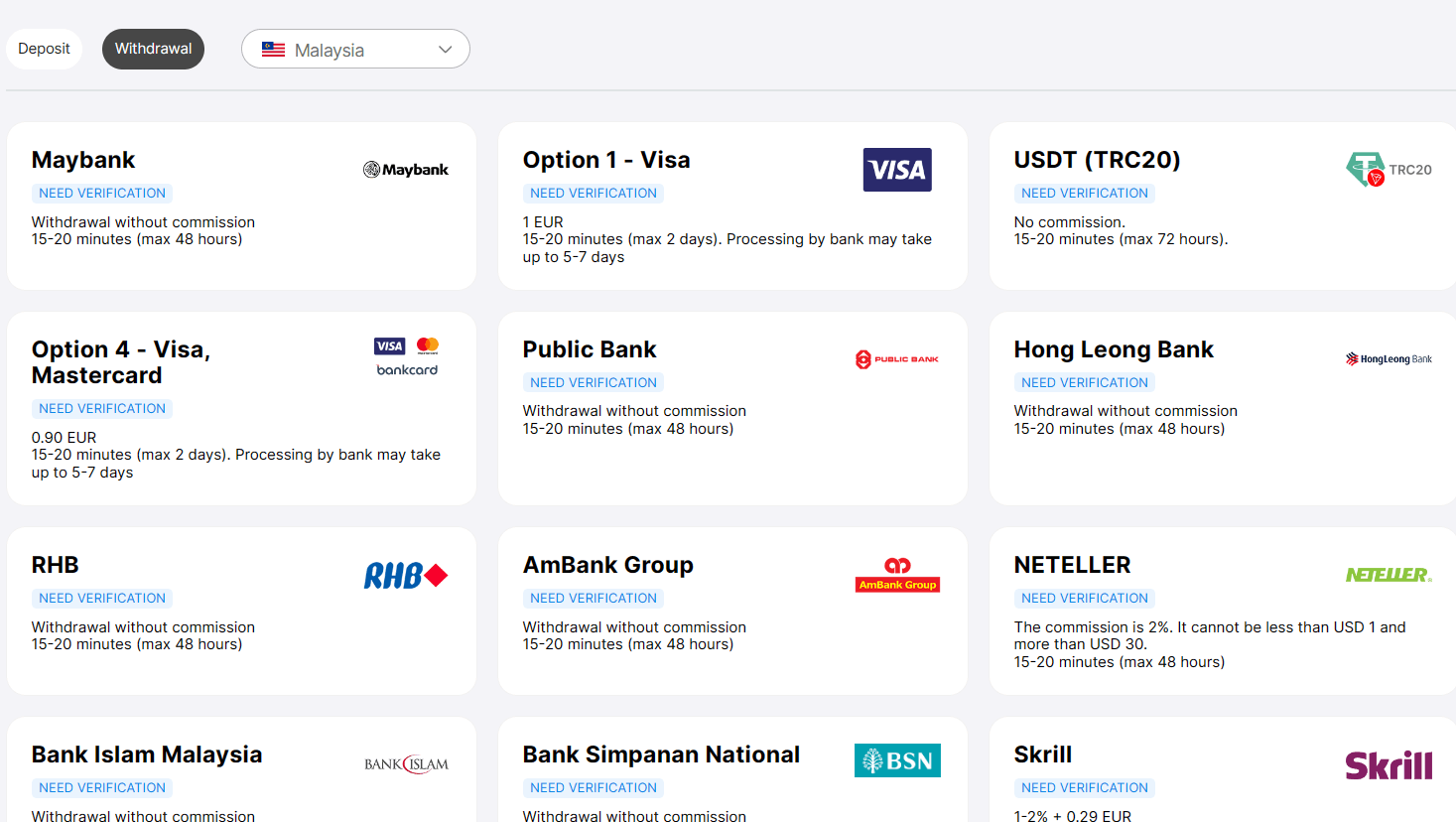

FBS offers relatively few options for traders to deposit and withdraw their funds. Currently, traders in Malaysia can deposit and withdraw their funds through Bank Transfers, Visa, Neteller, SticPay, Skrill, Perfect Money, and local exchangers.

There are 2-3 local banks in the list of accepted payment methods in MYR. The deposits are instant.

Traders should remember that FBS also charges a deposit and withdrawal fee. The exact fee that will be charged depends on the mode of deposit or withdrawal.

The withdrawals can take upto 48 hours at FBS depending on your bank or other payment method. Here is the screenshot from their platform on the withdrawal methods for Malaysians.

The withdrawal requires your account to be fully verified by FBS.

Deposits can be made in MYR, however, the MYR will be converted into USD or EUR depending on the day’s exchange rate. There might be a conversion fees involved.

FBS Account Types

FBS offers traders a large selection of accounts to choose from. The five different types of accounts offered are Cent, Standard, Micro, Zero Spread, and ECN. Each type of account has its own pros and cons and is suitable for different types of traders. For example, the Zero Spread account is suitable for high-volume traders.

Traders should also note that the base currency for each account type is either USD or EUR. MYR is not offered as a base currency by FBS. The deposits can be made in MYR, however, the amount will be converted to either USD or EUR.

Additionally, FBS also offers swap-free Islamic accounts to people in Malaysia.

FBS has a minimum deposit of 1 USD.

Here is a breakdown of the different types of accounts offered by FBS.

Islamic Account – Every type of account can be converted into a swap-free Islamic account. Under Islamic accounts, no swap rates are charged by FBS as per Islamic law. However, traders from Malaysia should know that CFD instruments cannot be traded from an Islamic account.

Cent Account – The initial deposit that needs to be made under the Cent account is $1. Traders will be charged a floating spread starting from 1 pip. This account does not charge a commission. The leverage under this type of account can be a maximum of 1:1000.

Standard Account – Traders will need to make an initial deposit of $100. The floating spread will be at least 0.5 pips. Standard accounts do not charge a commission. The leverage can be as much as 1:3000.

Micro Account – The initial deposit that needs to be made is $5. Traders will be charged a fixed spread that starts from 3 pips. No commission will be charged under this type of account. Traders can use a leverage of up to 1:3000.

Zero Spread Account – The initial deposit under this account is $500. Traders will be charged a fixed spread which starts from 0 pips. Additionally, traders will also be charged a commission which would be upwards of $20 per lot. The leverage under this type of account can be as much as 1:3000.

ECN Account – The initial deposit for an ECN account is $1000. Traders will be charged a floating spread starting from -1 pip. A commission of $6 will be charged for every trade. The leverage under this type of account can be a maximum of 1:500.

Additionally, FBS also offers copy trading services through its social trading platform. These copy trading services allow users to follow the trades made by other investors and traders. Traders can also earn a commission if their trades are followed by other traders.

FBS Trading Instruments

FBS gives Malaysian traders the option of trading 28 currency pairs, 4 index CFDs, 2 commodity CFDs, 4 metal CFDs, and several stock CFDs. Additionally, traders can also trade 9 exotic currency pairs.

Traders in Malaysia should note that exotic currency pairs and CFDs cannot be traded through an Islamic account.

Overall, FBS offers an average range of instruments that traders can trade. Their selection of CFDs apart from stocks is considerably low. Further, they do not offer cryptocurrencies for trading such as other similar brokers like HotForex.

FBS Trading Platforms

FBS offers traders the option of using either MetaTrader or their new proprietary trading platform called FBS Trader.

The MetaTrader 4 and MetaTrader 5 trading platforms offered by FBS are popular among traders and they offer high functionality while being easy to use.

The MT4 and MT5 trading platforms are available on smartphones, desktops, laptops, web browsers, and tablets. Both these trading platforms are available for both Windows and Mac users. Additionally, their smartphone app is available for download on Android as well as iOS.

The FBS Trader trading platform is currently only available for smartphone users. Both Android and iOS users can use this trading platform.

FBS Customer Support

There are several ways in which a trader or a prospect can contact FBS’s customer support team. They are available through live chat on their website or you can request a callback from them.

Additionally, FBS can be reached through social media platforms such as Facebook and Twitter. FBS can also be reached through a variety of messaging apps such as Viber, WhatsApp, WeChat, and more.

Live Chat – While writing this review, we frequently contacted their customer support team through the live chat option on their website. The hold time was an average of 1 minute after which you connected to a support agent.

They answered our questions quickly and we found them to be helpful.

Callback – Traders in Malaysia can also request their customer support team to make a callback. There is a contact form available on their website through which the request can be placed.

Do We Recommend FBS Malaysia?

FBS Malaysia is not a regulated entity as per local laws. You will be registered under IFSC, therefore you must understand the risks if you do decide to signup with them.

If you do decide to trade with them, make sure that you have proper knowledge of the risks of dealing with an offshore entity & depositing your funds with them.

They have a separate website for Malaysian traders and the language of the website can be changed to the local language.

They are reputed international forex and CFD broker and are considered to be safe to trade through. They have a long track record of sound performance.

Their customer support is helpful and they respond quickly. They offer a wide variety of promotions and bonuses for traders to enjoy.

They also offer Islamic accounts that do not charge swap rates.

The main drawback to trading through FBS is that they do not have a wide variety of instruments to choose from. Additionally, they charge a deposit and withdrawal fee which can make trading with them expensive.

FAQs on FBS Review

What is the minimum deposit for FBS?

The minimum deposit for FBS is $1 for trading with their Cent trading account. In case you want to go with ECN account the minimum deposit will be $1000.

Is FBS legal in Malaysia?

No, FBS forex broker is not regulated by SCM, and hence you are trading at your own risk. They are also on their Investor alert risk, and your account is opened under foreign offshore regulator. Therefore, you should avoid FBS until they are locally regulated or you are trading at your own risk.

What is the minimum withdrawal for FBS?

The minimum withdrawal amount depends upon the payment method that you will choose. For getting withdrawal via bank wire transfer the amount will be $50 and for other cards and E-Wallets the withdrawal amount should be $1.

Does FBS accept deposits & withdrawals in Malaysia?

Yes, you can deposit & withdraw in MYR via bank account. They accept payments via different banks, with the lowest amount as 30 MYR. The withdrawals via bank transfers are usually made within 30-40 minutes, but can take upto 48 hours.

How long does FBS withdrawal take?

FBS broker accepts all withdrawal requests within 48 hours. In case of the bank wire transfer, the amount can take upto 5 to 7 days for credited in client’s account depending upon the bank.

FBS Malaysia Kenya