Octa Review 2024

Octa is a low cost CFD broker that is popular in Malaysia. Their trading fees is low & support is good too, but have limited number of trading instruments. Read our review to decide if you should choose them or not?

By: Editor

—

TradeForexMalaysia Editor

Regulated By: MISA, CySEC, FSCA

Headquarters: St. Vincent and Grenadine

Octa (OctaFX) is a popular CFD broker that has been operating since 2011 & accepts traders from Malaysia. More than 1.5 million trading accounts have been registered with them globally.

Octa offers three different kinds of trading accounts and the fees that it charges depend on the type of account.

Users have the option of using the MetaTrader 4, MetaTrader 5, or OctaTrader trading platforms (their fees is spreads only with all these accounts). Octa is relatively less regulated than other comparable brokers and holds licenses from Tier-2 CySEC and Offshore regulator Mwali International Services Authority.

Compared to other CFD brokers, Octa offers a limited number of currency pairs for trading. You can trade 35 currency pairs. But otherwise, they have wide number of CFD instruments including & 10+ CFDs on commodities, 30 cryptocurrencies, 150+ stock CFDs and 10 indices. But they offer copy trading feature.

In this Octa Malaysia review, we’ve compared every pros & cons, and everything you need to know about Octa before choosing them.

Octa Malaysia Pros

- Octa is a low cost CFD broker, and they charge low fees overall without any hidden fees.

- Negative Balance Protection is available at Octa Malaysia

- Chat support available in Bahasa Malay & English.

- Offers choice between MT4, MT5 and OctaTrader trading platforms for mobile, desktop & web.

- Islamic Account is available at Octa.

Octa Malaysia Cons

- Not well-regulated. Only with 1 Top Tier regulator CySEC.

- There is no local phone number for support in Malaysia.

- Fewer currency pairs (35 on OctaTrader & MT4, 52 on MT5). No stock CFDs on OctaTrader

Octa Malaysia – A quick look

| 👌 Our verdict |

#1 Forex Broker in Malaysia |

| 🏦 Broker Name |

Octa Malaysia |

| 💵 Typical EURUSD Spread |

0.7 pips (with Micro MT4 Account) |

| 📅 Year Founded |

2011 |

| 🌐 Website |

https://www.octafxmy.com/ |

| 💰 Minimum Deposit |

$25 |

| ⚙️ Maximum Leverage |

1:500 |

| ⚖️ Regulation |

MISA,CySEC, FSCA |

| 🛍️ Trading Instruments |

35 currency pairs (52 om MT5), 100+ CFDs on Indices, Stocks, Cryptos, Metals |

| 📱 Trading Platforms |

OctaTrader, MT4 & MT5 for desktop, web & mobile |

Is Octa Malaysia Safe?

Octa is regulated by one Tier-2 financial regulator. However, being licensed to operate by fewer financial authorities does not automatically mean that Octa is not a safe broker. They have been operating since 2011, so have a track record.

Octa is regulated and authorized under following regulators:

- Octa is registered with the MISA i.e. Mwali International Services Authority under name ‘Octa Markets LTD’ – under license No. T2023320.

- Octa is registered with the CySEC of Cyprus under name ‘Octa Markets Cyprus Ltd’ – which is authorized and regulated by CySEC with license No. 372/18.

- Orinoco Capital (Pty) Ltd is their registered entity in South Africa and holds license no. 51913 from the FSCA.

Is Octa a safe forex broker for Malaysian traders? When you trade with Octa, it is at your own risk, because they are not regulated in Malaysia.

Octa is listed on the Investor alert list at SC (which also includes all forex brokers), therefore, all investor who trade forex from Malaysia should be cautious as you are not doing so under any local regulation.

It is also worth mentioning that Octa also maintains other security procedures to enhance the safety of traders. These practices include segregation of funds, anti-money laundering policies, and negative balance protection.

Octa is less well-regulated than other comparable brokers, however, they have been in operation since 2011 and are trusted by thousands of users worldwide.

Octa Malaysia Fees

Octa does not charge any commissions or other fees. Traders pay the spreads associated with each instruments.

Traders can get an idea of how much is the cost of trading at Octa Malaysia by using a few benchmark examples.

Here is a breakdown of trading fees at Octa Malaysia:

- Low Typical Spread – The average or typical spread that is charged is nearly the same for all three accounts. For a trader using the MT4 account, the typical spread charged for trading the benchmark EURUSD currency pair is 0.7 pips. This is almost the same on MT5 & OctaTrader accounts.

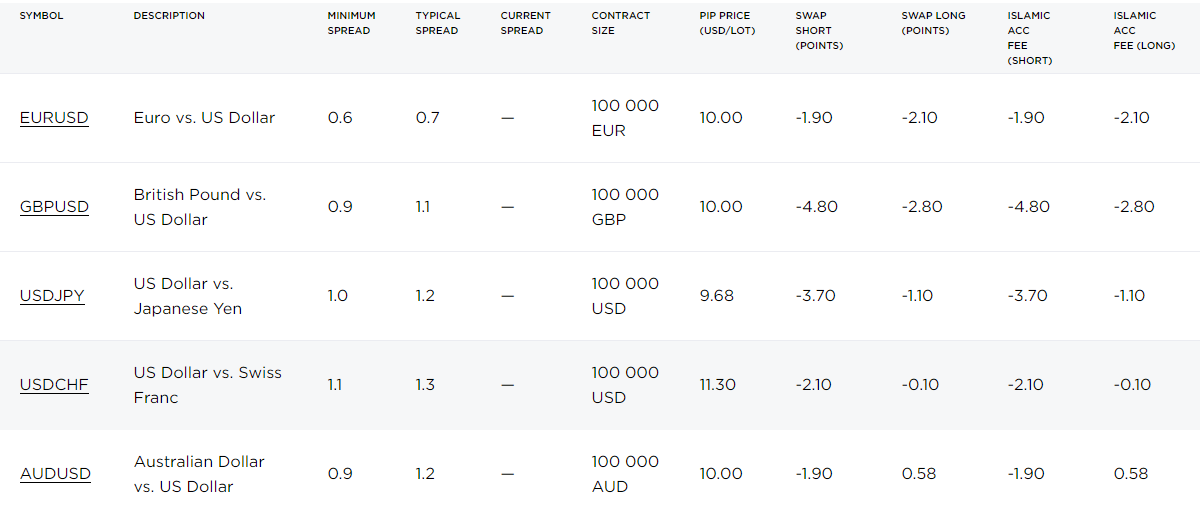

Below screenshot of table from their website shows the fees with their Metatrader 4 account.

The spread that they charge is quite competitive when compared to other similar brokers like Exness & XM.

In addition to a spread, Octa does not charge any swap rates, and there are no commissions.

- No Commissions – No commission is charged from traders who are using the any accounts at Octa. .

- Zero Deposit and Withdrawal Fees – They recommend a deposit amount of USD 20 for all accounts. Octa does not charge any deposit or withdrawal fees for any account type. They also do not charge any conversion fees. This makes Octa an overall reasonably priced broker to trade through.

- No Inactivity Fees – Octa does not charge an inactivity fee. This means that you can keep your account dormant for extended periods of time if you’re taking a break from trading.

Overall, Octa does not charge any hidden fees that we noticed. Plus they have an option to open an Islamic account for Swap Free trading. We found that Octa is an affordable forex broker.

What is Octa’s fees for forex trading?

Octa (OctaFX) only charges variable spreads for currency trading. There is no commission or any other charge except for their spreads. For example, if you are trading EUR/USD, the spread typically is around 1 pip under MT4 account.

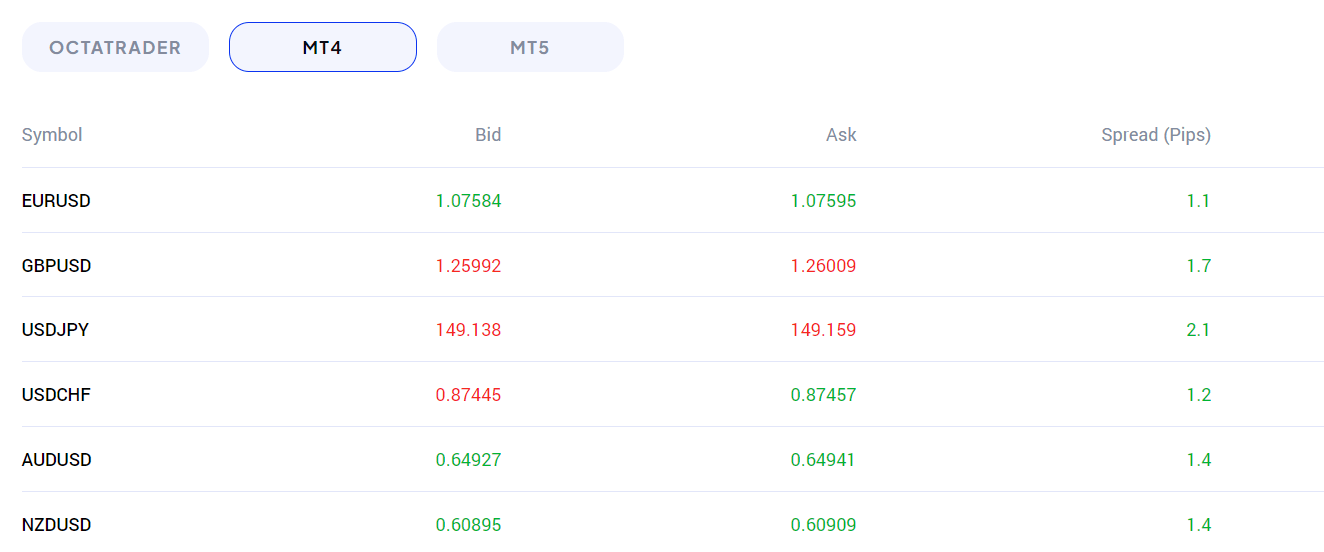

Below is the screenshot of their live spreads taken during the NY session opening. The actual spreads may be higher or lower depending on the market volatility.

If you are trading 1 standard lot (100,000 units), you will pay USD 10 in spread to Octa under this assumption. This is not the lowest spread for majors as there are brokers with lower spreads, but for traders who prefer straightforward model of spreads for trade, this fees structure works okay.

How much is the trading charges overall at Octa?

If you add it up all, you pay a variable spread only. So, if you are trading GBP/USD for example on OctaTrader, the typical spreads are 1.2 pips normally intraday during active sessions.

If you trade 20 standard lots in a month, you will be paying $12 (per lot on GBP/USD) multiplied by 20. That is $240 for your trading activity for that month. The real charges will totally depend on two factors: the instrument you are trading, the variable spreads at the point of time.

Based on our research, the overall cost of trading CFDs at Octa is not the highest, because other brokers like FXTM, HFM charge higher or the same. Some instruments at Octa have higher spreads compared to other brokers. For example, their GBP/USD spread is not the lowest, but their EUR/USD spreads are very competitive if you are trading on OctaTrader.

Their spreads on Indices CFDs are very competitive. For example, the spreads on DE40 is 2 pips, which is the lowest compared to other CFD brokers. Other brokers charge more than 20 pips on trading DE30 & DE40.

Octa Bonus

For new account openers, Octa offers a 50% deposit bonus & this offer is available to traders in Malaysia.

But to withdraw the bonus funds, you need to trade half the number of standard lots equal to the bonus that you receive.

Octa Deposit and Withdrawal

Octa offers a variety of deposit and withdrawal methods for traders in Malaysia.

The following deposit funds options are available at Octa Malaysia

- Local Bank deposit: Traders in Malaysia can make a deposit through their local bank in their Octa account. Normally the funds are tracked & added within the same business day.

- Credit/Debit Card: They also have the option of making deposits through their debit or credit cards.

- EWallets: Additionally, a variety of payment wallets are also accepted for making deposits and withdrawals. Octa accepts deposits via Ewallets like Skrill & Netteller. The funds added using this method are added within few minutes.

- Bitcoin: Octa also allows you to make your deposit using cryptocurrencies like Bitcoin.

Octa does not charge any deposit or withdrawal fees which makes it highly attractive to open an account with them.

Octa Account Types

Octa offers 3 different types of accounts and each of them is suitable for different kinds of traders.

What is the minimum deposit for Malaysian traders at OctaFX?

The minimum deposit at Octa Malaysia is $20 with all accounts. The base currency of all types of accounts can be either EUR or USD for all types of accounts for Malaysian traders.

In this section, we will be discussing the different account types as applicable to Malaysian traders since the terms and conditions may differ from jurisdiction to jurisdiction.

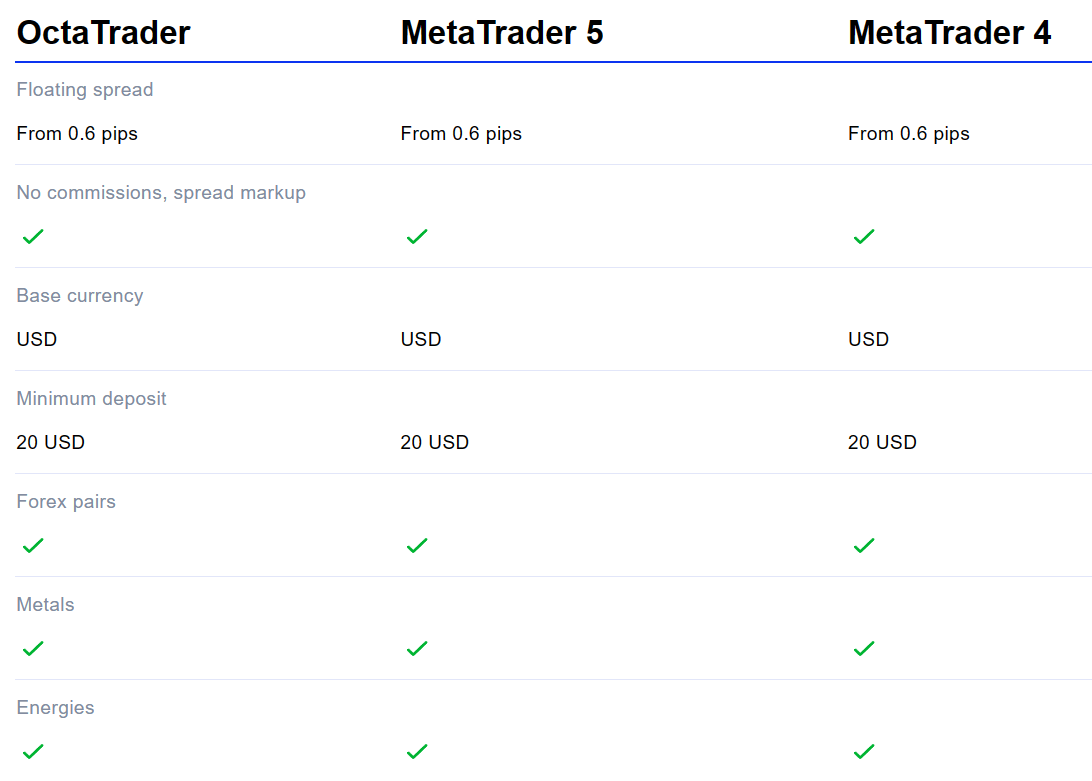

1. Octa MT4 – The trading platform that is available for this type of account is MetaTrader 4. The floating spread for this type of account starts at 0.6 pips. They do not charge a commission when trading through this type of account.

A trader has the option of choosing between 35 currency pairs, gold and silver, 30 cryptocurrencies, and different indices. For currencies, a trader gets leverage of 1:500. Swaps are optional.

2. Octa MT5 – Pro users can trade through the MetaTrader 5 trading platform. The floating spread starts from 0.6 pips. They do not charge a commission. The minimum deposit is USD 20.

You can trade between 35 currency pairs, gold and silver, 2 energy, 10 indices, and 30 cryptocurrencies. For currencies, they offer a leverage of 1:200. This account type does not offer swaps.

3. OctaTrader – ECN account users can trade through their proprietary trading platform. The floating spread starts at 0.6 pips. The minimum deposit for OctaTrader account is USD 20. You cannot run your EAs on this platform, for running your EAs, you have to trade on MetaTrader.

Traders have the option of trading between 35 currency pairs. CFDs on most instruments are available, but you cannot trade stock CFDs with on OctaTrader. Traders can get a leverage of 1:500 for trading currency pairs and 1:200 for trading gold and silver. No swaps are available.

Octa Trading Instruments

The availability of instruments depends on the type of account that is being used. The MT5 account type offers the widest range of instruments to trade.

Through Octa, you have the option of trading 35 currency pairs, CFDs on gold and silver (and other commodities), 2 energy instruments, 10 different indices, 150+ stock CFDs and 10 different cryptocurrencies.

The leverage that is offered depends on the type of account and the type of instrument that is being traded.

With Octa, you can trade using your mobile, web browser, or desktop regardless of the trading platform. For users who want to trade stock CFDs, you would need to open MT5 account, because you cannot trade stock CFDs on Octa MT4.

Octa primary offers their proprietary platform OctaTrader, which is available on all devices. The platform has most of the features, but the downside is that you cannot trade CFDs on stocks on their proprietary platform.

Web Trading Platform – Their web trading platform be used if you want to trade through your internet browser. This offers a quick and convenient way for you to access the trading platform. The web trading platform supports all popular web browsers.

Mobile Platform – You can enjoy a user-friendly trading experience straight from your mobile phone. If you’re on the go or have a long commute then using a mobile platform can be the best choice for you.

Desktop Trading Platform – This is functionally and design-wise similar to the web trading platform. In the desktop version, you are offered greater functionality than in the web version.

Overall, FXTM offers a standard trading experience thanks to its use of the MT4, MT5, and cTader trading platforms. They do not have a proprietary trading platform of their own, which can be an advantage if you are used to using these third-party platforms.

Octa Customer Support

Octa offers support via 3 mediums to traders in Malaysia, including chat support, email, and Telegram. But the best way to reach customer support for Octa is to use the live chat that is available on their website.

- Good Live Chat support: Live chat is available in Bahasa Malay and English. Their live chat option was found to be highly responsive and helpful in answering our questions.

Their English chat support is available 5 days a week, for 24 hours. But their Malay chat support is only available during the daytime in Malaysia.

- Email Support is Okay: In addition to live chat, you can reach out to Octa by filling out the contact form on their contact page or emailing [email protected]. We received a response from their team within 4 hours, which is great compared to other brokers.

- Telegram: Octa also offers option to contact them via Telegram app. We did not test this support channel.

Overall, we found Octa’s Malaysian support to be good. We like the fact that they have operators offering support in the local language too.

Can I trade stock CFDs Octa Malaysia?

Yes, you can trade CFDs on major US, European & UK stocks on Octa MT5 platform. Note that you cannot trade stock CFDs on MT4 or OctaTrader. There are 150 stocks instruments available as CFDs on Octa MT5.

You don’t have to pay any commission when trading these stocks, nor is there any swap charges. You can access up to 1:20 leverage on stock CFDs.

What will be the cost for trading these stocks on Octa? In short, you will have to pay the variable spreads when you trade. For example, the typical spreads on trading Apple CFD is 2.1 pips. If the bid is 187.79, the ask price will be 188, to give you an understanding of the cost.

If you are holding 10 shares, then the cost in this example would be around USD 21. You can increment this to the number of shares you want to trade (calculated based on your CFD contract lot size).

Do We Recommend Octa Malaysia?

The traders trading with Octa (OctaFX) in Malaysia are choosing them at their own risk as they are not regulated. You risk losing your deposited funds.

Although Octa is a popular forex broker, but they score low in terms of overall trust score in our research. They are not regulated by multiple Tier-1 regulators. They are although regulated under CySEC & FSCA, which are Tier-2 regulators.

There are both pros and cons to trading through Octa, but you must make your own decision given then risks.

The overall fees that Octa charges are lower than most other brokers, which makes than an attractive choice for traders looking for a low-cost broker. They also do not charge any hidden fees.

The customer support offered through live chat is quick and helpful, and also available in the local language. Plus, you can request a callback too.

But, many traders will find that the instruments that they offer are quite limited compared to other brokers. Also, Octa is less well-regulated than comparable brokers and is only regulated by a single Tier – 1 regulator.

However, Octa has a good track record and is used by users across many countries. They also have separation of funds and anti-money laundering policies in place.

Overall, we believe it is moderate to high risk to trade forex & CFDs with Octa if you are a trader based in Malaysia.

FAQs on Octa Malaysia

How do I withdraw money from Octa Malaysia?

Octa withdrawal request can be submitted via the client panel. You will see full payment option based on your region while submitting the withdrawal request. The process normally takes 1 to 3 hours during working days.

Is Octa legal in Malaysia?

No, Octa is not legal or locally regulated in Malaysia, therefore you are trading with this broker at your own risk. BNM has issued warnings against Octa in the past. The account of traders from Malaysia at Octa are opened under offshore regulation.

Are my Funds safe with Octa Malaysia?

Traders from Malaysia are registered under ‘Octa Markets Incorporated’, which is registered offshore. Octa claims to have segregated accounts. There have not been many complaints by traders not being able to withdraw their funds through Octa in Malaysia, but you must note that you are depositing funds with them at your own risk as they are not locally regulated.

What is the minimum withdrawal on Octa?

The Minimum withdrawal in Octa with local banks is 20 RM (maximum is 50,000 RM), with Bitcoin the minimum is 0.000092 BTC, with Ethereum is 0.005 ETH, with Litecoin is 0.11 LTC, Tether (ERC20, TRC20) is 20 USDT and Dogecoin is 75 DOGE, with Neteller and Skrill is 5 USD and with VISA is 20 USD.

What is minimum deposit in Octa?

The minimum deposit in Octa is only $20 with their Metatrader 4 Account. Octa introduced various local payment methods and local bank transfer for deposits. You can make deposit using any of your preferred method.