Pepperstone Malaysia Review 2023

Pepperstone is a reputed global broker that offers social trading capabilities.

Pepperstone is an ECN forex and CFD broker that accepts clients from Malaysia. However, they do not have a dedicated website for Malaysian traders and their website is not available in Malay.

PepperStone Group was founded in 2010 & is regulated by several reputed financial authorities. The Pepperstone group’s companies are regulated by the ASIC of Australia, FCA of the UK, DFSA of the UAE, CySEC of Cyprus, CMA of Kenya, SCB of the Bahamas, and BaFin of Germany. Clients registering themselves from Malaysia are registered under the jurisdiction of the SCB of the Bahamas.

Pepperstone offers swap-free (Islamic) accounts to traders in Malaysia. Traders using this type of account are not charged any interest. Additionally, Pepperstone offers Standard and Razor accounts. The Standard account is suitable for new traders while the Razor account is meant for scalpers and algorithmic traders.

Pepperstone offers a wide range of trading platforms. Traders can choose to use MetaTrader 4, MetaTrader 5, cTrader, or social trading platforms. They do not have a proprietary trading platform.

In total, Pepperstone offers more than 180 trading instruments including 60+ currency pairs, indices, commodity CFDs, share CFDs, cryptocurrencies, and currency indices.

Check out our review below which discusses the various aspects of Pepperstone’s services including fees, safety, trading conditions, and customer support.

Pepperstone Malaysia Pros

- They offer MT4, MT5 and cTrader trading platforms.

- They charge low fees and do not charge any hidden fees.

- Pepperstone offers Negative Balance Protection.

- PepperStone is regulated by two Tier- 1 financial authorities ASIC (Australia) & FCA.

- Islamic account is available for Malaysia based traders.

- CFDs on multiple cryptocurrencies also available.

Pepperstone Malaysia Cons

- Pepperstone does not offer their services in Malay and does not have a dedicated Malaysian website.

- PepperStone does not offer investor protection to traders in Malaysia.

- No local office in Malaysia.

Pepperstone Malaysia – A quick look

| 👌 Our verdict on Pepperstone | #14 Forex Broker in Malaysia |

| 🏦 Broker Name | Pepperstone Malaysia |

| 💵 Typical EUR/USD Spread | 1 pips (with Standard Account) |

| 📅 Year Founded | 2010 |

| 🌐 Website | https://pepperstone.com/en/ |

| 💰 Pepperstone Malaysia Minimum Deposit | AUD $200 |

| ⚙️ Maximum Leverage | 1:500 |

| ⚖️ Pepperstone Regulations | ASIC, FCA, CySEC, DFSA, CMA, SCB, BaFin |

| 🛍️ Trading Instruments | 60+ currency pairs, indices, commodity CFDs, share CFDs, cryptocurrencies, and currency indices. |

| 📱 Trading Platforms | MT4, MT5 for desktop, tablet, web & mobile along with cTrader. |

Is Pepperstone Safe?

Pepperstone is considered to be a low-risk CFD broker as they have a long track record of catering to global clients. They are regulated by tier-1 financial authorities such as the FCA of the UK and the ASIC of Australia.

Pepperstone is regulated by the following Top-tier financial authorities:

- Pepperstone is registered with the Securities Commission of The Bahamas (SCB) under the name Pepperstone Markets Limited and holds the license number SIA-F217.

- Pepperstone is registered with the Cyprus Securities and Exchange Commission under the name Pepperstone EU Limited and holds the license number 388/20.

- Pepperstone is registered with the Financial Conduct Authority of the UK under the name Pepperstone Limited.

- Pepperstone is registered with the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) of Germany under the name Pepperstone GmbH.

- Pepperstone is registered with the Australian Securities and Investments Commission (ASIC) in Australia under the name Pepperstone Group Limited.

- Pepperstone is registered with the Dubai Financial Services Authority (DFSA) in the UAE under the name Pepperstone Financial Services Limited.

- Pepperstone is registered with the Capital Markets Authority (CMA) in Kenya under the name Pepperstone Markets Kenya Limited.

As evident, the different group entities of Pepperstone are well-regulated. Malaysian traders who open an account with Pepperstone are registered under their The Bahamas license. However, no investor protection is granted to traders from Malaysia.

Pepperstone does offer negative balance protection. In the case of a fast-moving market, the balance in a trading account my turn negative. Such negative balance is waived on a case-to-case basis.

Overall, we consider Pepperstone to be a safe broker for traders in Malaysia for the above reasons.

Pepperstone Malaysia Fees

Pepperstone charges a variety of trading and non-trading fees from its traders. The exact fees charged depend on a range of factors.

Here is a breakdown of the overall fees (trading & non-trading) charged by Pepperstone.

Tight Variable Spread – The spread charged by Pepperstone depends on the market conditions at the time of entering the trade and the instrument being traded. It also depends on the type of account held by the trader. The spread charged under the Standard account is much higher than the Razor account.

The typical spread for trading the benchmark EUR/USD currency pair for traders using the Standard account is 1.09 pips.

The typical spread for trading the benchmark EUR/USD currency pair for traders using the Razor account is 0.09 pips.

We checked the average spread charged by Pepperstone from their website.

No Commission Under Standard Account – Pepperstone does not charge a commission under the Standard account, however, the spread charged is higher. Under the Razor account, the spreads are lower but a commission is charged.

The commission charged under the Razor account depends on the base currency of the trading account. If the base currency is USD, then the commission charged for trading 1 lot is USD 3.5.

Swap Rates – Usually, Pepperstone charges a swap rate for holding an open position overnight. However, traders in Malaysia can request a swap-free (Islamic) account in which no swap rate is charged. Swap rates are released on a weekly basis and are calculated based on market conditions. Each currency pair has its own swap rate.

No Deposit or Withdrawal Fee – Pepperstone does not charge an extra commission or fees on deposits or withdrawals. This is a good feature.

No Inactivity Fee – Pepperstone does not charge any inactivity or account-keeping fee. A trader can open an account and keep it dormant without incurring any fee.

Overall, Pepperstone charges low fees compared to another similar broker. Their fee structure is clear and provided on their website. They do not charge any hidden or non-transparent fees.

Pepperstone Bonus

Pepperstone does not have a variety of promotional offers for its traders. However, they do have a Refer a Friend program. Under the program, the person making a reference to a new client will get a reward of $100 AUD (or equivalent).

Pepperstone Deposit and Withdrawal

Traders in Malaysia can deposit funds to their accounts or make a withdrawal in several different ways. Pepperstone does not have an extra charge on funding or withdrawal. But, depending on the mode of your payment, a trader may be charged a fee by the payment service provider like Ewallet or your bank.

Pepperstone accepts payments from Visa, Mastercard, Wire Transfer, POLi, Bank transfer, BPay, PayPal, Neteller, Skrill, and Union Pay. A withdrawal can also be made through the same methods.

Pepperstone Account Types

Pepperstone offers two primary types of accounts: Standard account and Razor account. Each of the account types is meant for different kinds of traders. The Standard account is meant for new traders whereas the Razor account is suitable for scalpers and algorithmic traders.

These trading accounts can also be converted into Islamic (swap-free) accounts. Traders can contact Pepperstone’s customer support team to get an Islamic account that will have the same trading conditions as the base account type. This feature is available to traders from a limited number of countries including Malaysia.

The minimum size of a trade is 0.01 lots. The available leverage is up to 1:500. The minimum account opening balance needs to be AUD $200. The base currencies that are available are AUD, USD, JPY, GBP, EUR, CAD, CHF, NZD, SGD and HKD.

Here is a breakdown of the different account types available at Pepperstone.

Islamic Accounts – Islamic or swap-free account does not charge a swap rate or rollover interest. The swap rate is an interest that is charged if a trading position is kept open overnight.

Traders using the Islamic account may be charged an administration fee. This fee is charged if an open position is held for a period longer than 10 days. The administration fee depends on the instrument being traded. For example, the admin fee for trading a currency pair is USD 50.

Standard Accounts – The Standard account does not charge a commission but has higher spreads. The average spread for trading the EUR/USD currency pair is 1- 1.3 pips.

Razor Accounts – The Razor account charges a commission, however, the spread is much lower. The average spread charged for trading the EUR/USD currency pair is 0 to 0.3 pips. The commission charged is AUD $7 per round turn of 1 lot.

How to Open Account with Pepperstone

Below are the steps to open an account with Pepperstone:

- Visit Website: Go to www.pepperstone.com.

- Register: Click “Open Live Account” or “Create Account.”

- Fill Form: Enter personal info and verify email.

- Verify ID: Upload valid ID and address proof.

- Deposit & Trade: Fund your account and start trading.

Congratulations! Your account has been created. Kindly follow the guidelines before start trading.

Pepperstone Trading Instruments

Traders can use Pepperstone to gain access to a high number of trading instruments, compared to other similar brokers. Pepperstone offers more than 180 different trading instruments including 60+ currency pairs, indices, commodity CFDs, share CFDs, cryptocurrencies, and currency indices.

One of the main advantages of trading with Pepperstone is that traders can access cryptocurrencies at very low charges. The typical spread charged for trading cryptocurrencies is 15 pips. Traders can also trade Bitcoin, Bitcoin Cash, and Ethereum on the weekends.

Pepperstone Trading Platforms

Pepperstone offers popular trading platforms like the MetaTrader 4, MetaTrader 5, and cTrader to its traders.

MetaTrader 4 – The MetaTrader 4 is one of the most popular trading platforms in the forex space. It is easy to use and has several intuitive features. It can also be customized according to the trader’s needs. The MetaTrader 4 is available on desktops (both Windows and Mac), laptops, web browsers, iPad, and smartphones (both Android and iOS).

MetaTrader 5 – The MetaTrader 5 is a newer version of the MT4 platform. It offers more advanced trading capabilities for different asset classes, compared to the MetaTrader 4. It is also available on all devices supported by the MetaTrader 4.

cTrader – cTrader is another trading platform favored by forex traders. It offers fast execution speeds along with coding customizations. It is suitable for both beginners and advanced traders. The cTrader is available on both Android and iOS. For desktops, it is available on Windows.

Social Trading Platforms – Pepperstone offers a variety of social trading platforms to its traders. These include Myfxbook, MetaTrader Signals, and DupliTrade. These social trading platforms allow traders to follow trades made by other traders.

Pepperstone does not offer its own proprietary trading platform.

Pepperstone Customer Support

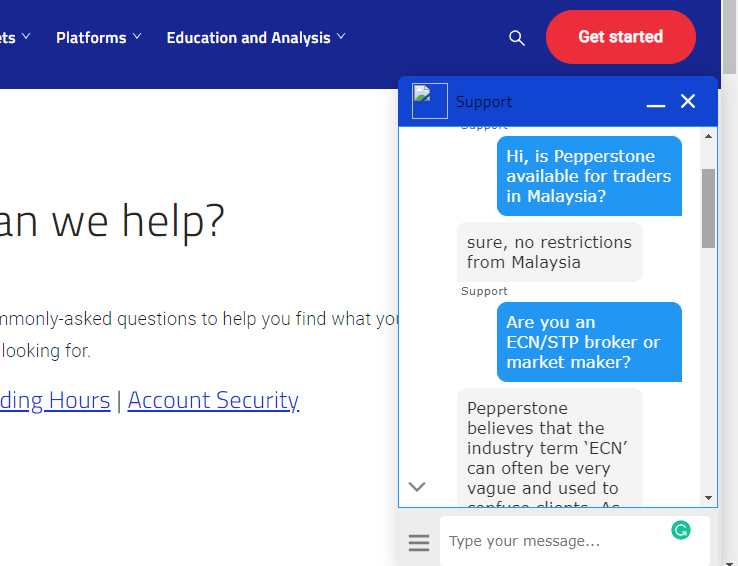

Pepperstone’s customer support team can be reached through a phone call, email, contact form on their website, and live chat on their website.

Phone – Pepperstone has an international number that can be called. They do not have a dedicated Malaysian phone line. This option is available 24/5.

Live Chat – We tried Pepperstone’s live chat option and found it to be very helpful. The response time was less than one minute on average.

Email – Traders can contact the support team through a dedicated email ID.

Do We Recommend Pepperstone Malaysia?

Yes, we recommend Pepperstone to Malaysian traders because they are a trusted provider regulated b multiple top-tier regulations including ASIC, FCA & CySEC.

PepperStone offers trading services at a relatively low cost compared to other brokers. They have a wide range of trading instruments including 60+ currency pairs and cryptocurrencies. Their customer support is responsive and helpful. They also offer social trading options. They offer Islamic accounts to Malaysian traders. Further, they are well-regulated.

However, there are a few drawbacks to trading with Pepperstone.

They do not offer their services in Malay and do not have a dedicated Malaysian website. They do not offer MYR as a base currency. Their customer support is not available through a local phone number and they do not have an office in Malaysia. So, investor protection is not available or limited for traders based in Malaysia.

Overall, we recommend Pepperstone since they are a safe and reputed forex CFD broker.

FAQs on Pepperstone Review

Is Pepperstone a safe broker?

Pepperstone is regulated by various top-tier regulatories like FCA, ASIC, CySEC and CMA. Also Pepperstone use segregate account to store their client’s funds. So your trading pepperstone is totally safe.

How to withdraw money from pepperstone?

Withdrawal request can be submitted from the client panel under the Funds section. You also need to confirm the withdrawal request from the registered email by clicking on the confirmation link sent to you.

What is the minimum deposit for Pepperstone?

The minimum deposit requirement from Pepperstone is $200 with all trading account. And Pepperstone does not charge any transaction fee on funds deposit.

Pepperstone Kenya