You must note that there are no approved forex or CFD brokers in Malaysia for retail traders. All the brokers offering currency derivatives in Malaysia are operating without a license, and if you are trading FX with any broker (including in this research), you are doing it at your own risk.

We strongly suggest users in the region to not trade currencies online via foreign licensed CFD brokers, and wait until there is clarity or a legal framework for retail forex brokers. This research is only for education, and you should note that most of the foreign licensed foreign forex brokers (Tier-1 & Tier-2 included) are in SCM’s alert list.

Please understand the risks involved in dealing with any forex broker before you make any decision. We checked around 30 forex brokers that accept traders from Malaysia, and then research them individually based on multiple factors for our educational comparison.

Comparison Table of Best Forex Brokers in Malaysia

| Forex Broker | Minimum Deposit | Lowest EUR/USD Spread | Regulation(s) | Max. Leverage | Available Instruments | Visit |

|---|---|---|---|---|---|---|

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 0.7 pips

|

Regulation(s): CySEC, FSA

|

Max. Leverage:

1:500 |

Available instruments: 35 currency pairs, 10+ CFDs on Indices. Cryptos, Metals

|

Visit Broker | |

|

Minimum Deposit: $5

|

Lowest EUR/USD spread*: 0.6 pips

|

Regulation(s): FCA, FSCA, CySEC

|

Max. Leverage:

1:1000 (with Micro account) |

Available instruments: 49 currency pairs, and 100+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $5

|

Lowest EUR/USD spread*: 0.8 pips

|

Regulation(s): ASIC, CySEC

|

Max. Leverage:

1:888 |

Available instruments: 57 currency pairs, 1000+ CFDs

|

Visit Broker | |

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 0.0 pips on Pro Account

|

Regulation(s): FSCA, CySEC, FCA, FSA

|

Max. Leverage:

1:500 |

Available instruments: 62 Currency pairs, CFDs on 2 Metals, 14 Stock Indices, 3 Commodities & 4 Bonds

|

Visit Broker | |

|

Minimum Deposit: $10

|

Lowest EUR/USD spread*: From 1.3 pips (with Standard Account)

|

Regulation(s): FCA, CySEC, FSCA

|

Max. Leverage:

1:2000 |

Available instruments: 62 currency pairs, and several CFDs on spot metals, stocks, commodities, indices, and cryptocurrencies.

|

Visit Broker | |

|

Minimum Deposit: $100

|

Lowest EUR/USD spread*: 0.9 pips with Retail Account

|

Regulation(s): ASIC, CBI, PFSA, FSC, FSA, FSCA, FRSA

|

Max. Leverage:

1:400 for EUR/USD |

Available instruments: 60+ currency pairs, cryptocurrencies, major stock indices, commodities (including gold, silver, sugar, coffee), ETFs, individual shares and bonds

|

Visit Broker |

Best Forex Brokers in Malaysia

Here are the Forex Brokers that accepts traders from Malaysia based on our research:

- Octa – Best Forex Broker in Malaysia

- HF Markets – Forex broker in Malaysia with Zero Account

- XM Broker – Forex Broker for spread only account

- Tickmill – Best Raw spread forex broker

- FXTM – FCA Regulated ECN Forex broker

- AvaTrade – Best Forex broker for Fixed Spreads

- IC Markets – Forex Broker with Raw spread account

- Pepperstone – ASIC Regulated Forex Broker with Pro Accounts

- Oanda – Forex Broker with multiple licenses

- Fusion Markets – Good Forex Trading Platform

We have compared the features of each forex broker in our list in order, and we look at the different their features. Let’s see.

Important Note: Many forex brokers are unscrupulous and employ unfair business practices that exploit traders. If a broker is not regulated with any Tier-1 regulator, then they do not have to conform to safety & risk management standards.

Unlicensed forex brokers may not offer any financial protection in case of dispute, may not even keep funds deposited safe, or may not act in the best interest of traders. In case a trader faces an issue with such brokers, they cannot take legal recourse as they are not locally licensed.

Before choosing a forex broker, traders should check their licenses and which regulatory body has accorded that license. Not every regulatory body is highly reputable. Licenses by tier-1 financial authorities (which are the ASIC of Australia and FCA of the UK) hold the highest regard in the forex market among traders.

To be safe, all traders must only do business with a forex broker that holds multiple licenses from various top-tier financial authorities.

In this detailed guide, we provide a guide to the reputed forex brokers that accept traders from Malaysia (but note that these are not regulated locally, so you should understand the risks).

#1 Octa – Best Forex Broker in Malaysia

Regulations: CySEC, FSA

Minimum Deposit: $100

Available Platforms: MT4, MT5, cTrader for desktop, web & mobile

Octa (formerly OctaFX) was founded in 2011, but they are not licensed in Malaysia. They are only licensed with one major regulator CySEC, which makes them a higher risk CFD broker.

Note that no CFD brokers are licensed to offer forex trading to retail traders in Malaysia. Therefore, the traders who are trading are doing so at their own risk.

1) Safety: Octa is registered in St. Vincent and Grenadine and has been accorded license no. 19776 IBC 2011 from the Financial Services Authority (SVGFSA). Octa is licensed/regulated by the Cyprus Securities and Exchange Commission (CySEC) and holds license no. 372/18.

Based on their no. of licenses, they are not the safest in terms of overall counter-party risk. You should understand this risk with Octa.

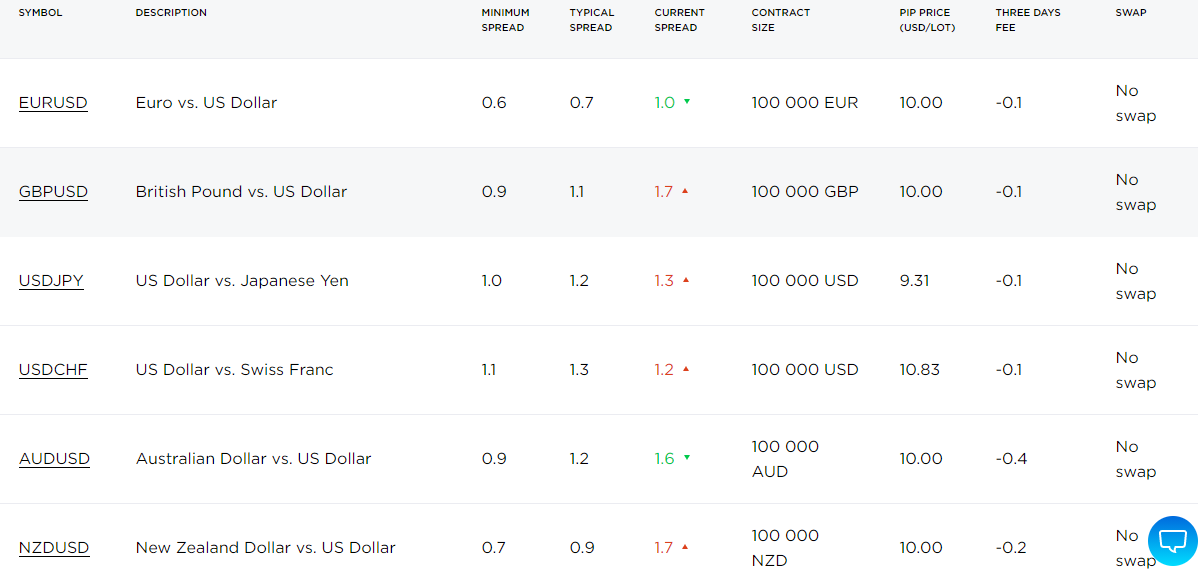

2) Fees: Octa charges a variable spread that depends on the type of account being used.

The average spread for EURUSD currency pair is 0.9 pips through the MT4 & MT5 accounts, but there is no commission involved. You only have to pay the spreads for trading currencies.

If you are trading 1 Standard Lot, then the typical fees for EUR/USD will be $9 each 100,000 units. This is the only fees Octa will charge you.

3)Trading Conditions: Octa offers relatively few trading instruments. They provide access to 35 currency pairs, 2 energy instruments, 10 indices, gold and silver, and 5 cryptocurrencies. Traders can use the MetaTrader 4, MetaTrader 5, or cTrader platforms depending on the type of account held by the trader.

4) Customer Support: Octa offers customer support through live chat or Telegram messaging app. They do not offer support through email or phone calls. The live chat on their website is available in Malay.

Octa Forex Broker Pros

- They offer negative balance protection and segregation of funds

- The overall fees is significantly lower than comparable brokers

- They offer customer support in Malay

Octa Forex Broker Cons

- Their selection of trading instruments is quite limited

- They do not provide customer support through phone call or email

#2 HF Markets – Best Forex Broker in Malaysia with Multiple Top-tier Licenses

Regulations: FCA, DFSA, FSCA, FSA.

Minimum Deposit: $5

Available Platforms: 53 currency pairs, CFDs on 6 metals, 4 energies, several indices, more than 56 shares, 5 commodities, 12 cryptocurrencies, 3 bonds, and 34 ETFs.

HF Markets (HotForex) is not approved or licensed in Malaysia, but they offer their services in Malay & accept traders in this region.

1) Safety: HFM is registered in St. Vincent and Grenadine and holds the registration number 22747 IBC 2015. This is the regulation under which your account is opened if you are a client from Malaysia. Your account is not under any Tier-1 regulation.

HF Markets Group is regulated by the Financial Conduct Authority (FCA) of the UK, Dubai Financial Services Authority of the UAE, Financial Sector Conduct Authority (FSCA) of South Africa.

They hold licenses under multiple major regulatory bodies. This makes them a broker with somewhat lower risk, but note that they are not licensed by the local regulator.

2) Fees: HFM charges a low variable spread and is spread only in 6 out of 7 types of accounts. The average spread for trading EURUSD currency pair (which we use as the benchmark for comparison) is 1.2 pips with Premium account (actual spreads are variable).

They charge a commission under the Zero account with two structures. They either charge USD 0.03 per 1000 lots or USD 0.04 per 1000 lots depending on the instrument being traded.

3) Trading Conditions: Through HotForex, traders gain access to 50+ currency pairs, 4 energies, 56+ shares, 4 metals, 12 cryptocurrencies, 34 ETFs, 3 bonds, and several indices. HotForex offers both MetaTrader 4 and MetaTrader 5 trading platforms. They provide negative balance protection.

4) Customer Support: The HotForex’s customer support is available 24/7, and you can contact them through live chat, email, phone call, fax, or a contact form on their website. They have a toll-free global phone number.

HFM Malaysia Pros

- HFM is a multi-regulated CFD & forex broker, holding licenses from FCA, DFSA, FSCA, CMA & other global & regional regulators. But we want to emphasize that they are not licensed in Malaysia, therefore you should be careful.

- They offer CFDs on ETFs and cryptocurrencies for trading along with a wide variety of instruments

- They offer Islamic accounts

- HFM is a low-cost broker, and their Premium account has low spreads for EUR/USD & other currency pairs.

HFM Malaysia Cons

- HFM is not licensed in Malaysia. You are trading with them at your own risk, with your account opened under foreign regulator, and there may not be any investor protection in case of dispute.

- The regional email support is not available in Malay

- They do not have a proprietary trading platform

#3 XM Broker – Forex Broker for spread only account

Regulations: ASIC, CySEC, IFSC, DFSA

Minimum Deposit: $5

Available Platforms: MT4, MT5 for desktop, tablet, web & mobile

XM was founded in 2009 and is an market maker forex and CFD broker.

1) Safety: The XM trading website is run by XM Global Limited which is licensed/regulated by the International Financial Services Commission (IFSC) of Belize. Additionally, XM group companies are regulated by the Australian Securities and Exchange Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), and Dubai Financial Services Authority (DFSA).

2) Fees: XM charges a tight floating spread and variable commission which depends on the type of account held by e trader. The average spread is 1.7 pips for trading the EURUSD currency pair through the Standard account. A commission of $0.04 per share with a minimum commission of $1 is charged for trading US shares through the Shares account.

3) Trading Conditions: Through XM, traders gain access to 55+ currency pairs, 8 commodities, 5 Energy CFDs, 1300+ stocks, 10 indices, gold and silver. XM offers the MetaTrader 4 and MetaTrader 5 trading platforms which provide fast order execution. XM grants negative balance protection to its traders.

4) Customer Support: XM offers customer support through email, live chat, and phone. They offer email support in Malay however there is no local phone number for Malaysian traders.

XM Broker Pros

- They offer Islamic accounts

- They observe safety practices such as negative balance protection and segregation of funds

- They have a wide variety of trading instruments, especially stocks

XM Broker Cons

- They do not have a proprietary trading platform

- They do not have a local office in Malaysia and no local phone number for customer support

- XM does not offer cryptocurrencies

#4 Tickmill – Best Raw spread forex broker

Regulations:FSCA, CySEC, FCA, FSA.

Minimum Deposit: $100

Available Platforms: MT4 (MetaTrader4), WebTrader

Tickmill is an STP forex and CFD broker and has a dedicated Malaysian website.

1) Safety: Malaysian traders come under the jurisdiction of the Seychelles Financial Services Authority (FSA) of Seychelles. Tickmill is also licensed by the Financial Conduct Authority (FCA) of the UK, Cyprus Securities and Exchange Commission (CySEC) of Cyprus, Labuan Financial Services Board (Labuan FSA), and the Financial Sector Development Authority (FSCA) of South Africa.

2) Fees: Tickmill charges a low variable spread. The average spread for trading the EURUSD currency pair is 0.1 pips. Tickmill charges a commission under its Pro account and VIP account. The commissions are $2 per side per 100,000 traded and $1 per side per 100,000 traded respectively.

3) Trading Conditions: Tickmill traders can trade 60+ currency pairs, 4 bonds, 14+ stock and oil indices, gold and silver. Tickmill users can use the MetaTrader 4 trading platform. They provide negative balance protection.

4) Customer Support: Tickmill can be reached through live chat on their website, a contact form on their website, phone call, or email. They do not have a local Malaysian phone number, however, their international line is available Monday to Friday between 7:00 – 16:00 GMT.

Tickmill Forex Broker Pros

- They do not charge any hidden fees and charge low overall fees

- Their customer support is available in Malay

- They offer Islamic accounts

Tickmill Forex Broker Cons

- Their selection of instruments is quite narrow

- They do not offer any social trading features

#5 FXTM – FCA Regulated ECN Forex broker

Regulations: FCA, CySEC, FSCA.

Minimum Deposit: $10.

Available Platforms: MT4, MT5 for desktop, tablet, web & mobile along with FXTM Trader.

FXTM provides STP brokerage services for forex and CFDs. Their website is available in Malay.

1) Safety: FXTM holds licenses by the Financial Conduct Authority (FCA) of the UK, Cyprus Securities and Exchange Commission (CySEC) of Cyprus, and the Financial Sector Development Authority (FSCA) of South Africa. They also provide segregation of funds.

2) Fees: The minimum spread under the Standard account is 1.3 pips for trading the EURUSD currency pair. FXTM only charges a commission from traders using the ECN account. The commission charged is $2 per lot. They charge a withdrawal fee and an inactivity fee.

3) Trading Conditions: Through FXTM, traders can access 62 currency pairs, commodities, indices, stock CFDs, spot metals, and cryptocurrencies. Traders can choose between the MetaTrader 4, MetaTrader 5, and FXTM Trader trading platforms. They offer negative balance protection to traders.

4) Customer Support: Traders can reach FXTM Malaysia’s support team through live chat, email, or phone call. The live chat on their website is also available in Malay (as well as English). They do not have a local Malaysian phone number.

FXTM Pros

- FXTM’s website and customer support are available in Malay

- They have a proprietary trading platform

- They offer Islamic accounts

FXTM Cons

- They do not have a local office in Malaysia

- They charge hidden fees such as a withdrawal fee (depending on the mode of withdrawal) and an inactivity fee

#6 AvaTrade – Best Forex Broker for Fixed Spreads

Regulations: ASIC, CBI, PFSA, FSC, FSA, FSCA, FRSA.

Minimum Deposit: $100.

Available Platforms: MT4, MT5 for desktop, tablet, web & mobile along with proprietary trading platforms.

AvaTrade is a market-making broker that offers forex and CFD instruments.

1) Safety: AvaTrade holds a license to operate from the tier – 1 financial authority ASIC of Australia.

Additionally, AvaTrade is licensed/regulated by the Central Bank of Ireland, Polish Financial Supervision Authority, British Virgin Islands Financial Services Commission, Financial Services Agency of Japan, Financial Sector Conduct Authority of South Africa, Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) of United Arab Emirates.

2) Fees: AvaTrade charges an average spread of 0.9 pips for trading the EURUSD currency pair using the retail account. They do not charge a commission. Further, they do not charge a deposit or withdrawal fee however their inactivity fee is high.

3) Trading Conditions: Overall, AvaTrade offers more than 250 trading instruments. Traders can access 60 currency pairs, ETFs, bonds, shares, major indices, and cryptocurrencies. They offer a wide variety of trading platforms including MT4, MT5, WebTrader, AvaOptions, AvaTradeGO, automated trading platforms, and Mac Trading. They also offer negative balance protection.

4) Customer Support: Customers can reach AvaTrade through live chat, phone call, or email. Each of their customer support modes are available in Malay. They offer a local Malaysian phone number that can be called.

AvaTrade Pros

- They have a dedicated website for Malaysian traders

- Their customer support is also available in Malay

- They are a highly regulated broker and offer several different trading platforms

- Traders can trade cryptocurrencies

AvaTrade Cons

- They charge a high inactivity fee after every three months

- They have limited deposit and withdrawal optionse

How to Choose the Best Forex Broker in Malaysia?

While choosing a forex broker, it is important to carry out your own independent research. Each forex trader has its own requirements. No particular forex broker is suitable for everyone. Here are the main factors that you should consider while choosing a forex broker.

1) Dealing Desk or No Dealing Desk: There are two kinds of brokers which are Dealing Desk brokers and No Dealing Desk brokers. They may also be known as STP brokers or market maker brokers respectively.

STP brokers do not have a conflict of interest with their traders but they may charge higher fees. Market-making brokers may have a conflict of interest but they may charge lower fees.

Generally, the forex brokers that are ECN or STP mention it on their website under the execution policy. Also, no dealing desk forex brokers will offer variable spreads & commission-based trading accounts

Let’s take HotForex for example. They claim to be an STP broker & they charge variable spreads with their account types. But XM is a market maker forex & CFD broker, and they also charge variable spreads, but they don’t have any ECN type account.

A good way to check this is to ask your forex broker via Live chat if they are STP or a market maker.

2) Regulation: There are no approved forex brokers in Malaysia. All the forex brokers that are onboarding Malaysia users are operating without a local license, since forex trading by retail investors is not regulated.

Still there are estimated to be over 100,000 traders in Malaysia, and these traders trade through foreign CFD brokers, which is risky & unregulated. You should wait until there is a local regulation to avoid trading through foreign CFD brokers.

For researching, we looked at the licensed held by the foreign forex broker who are popular in the region. Most of the major ones have one or more licenses from Tier-1 & Tier-2 regulators, which are FCA, ASIC, CySEC (not major but still accepted), FSCA, DFSA, FMA & others.

While checking a broker’s regulation, you should ensure that they (or the broker group’s entities) are regulated by reputed financial authorities. The top financial authorities in the world (which are also called tier-1 financial authorities) are the FCA of the UK and the ASIC of Australia.

To check regulations, you should visit the website of the forex broker and read their regulations page. Once you know the license number, you can also cross-check the license on the website of the financial authority. For example, you can see Octa’s regulations on this page, and they can be cross-checked on CySEC’s website.

Note that only have license with CySEC is not enough as this is not considered a regulator with high trust score. If the broker is licensed by FCA, ASIC, then it is considered to have a higher trust factor based on our research.

3) Fees: Every broker will usually have a page on which they display the typical spread that they charge for various instruments. You should always check the average spread for the EURUSD currency pair since it is considered the benchmark. You can then compare their average spread with other brokers.

Here is an example of the spread charged by Octa as found on their website.

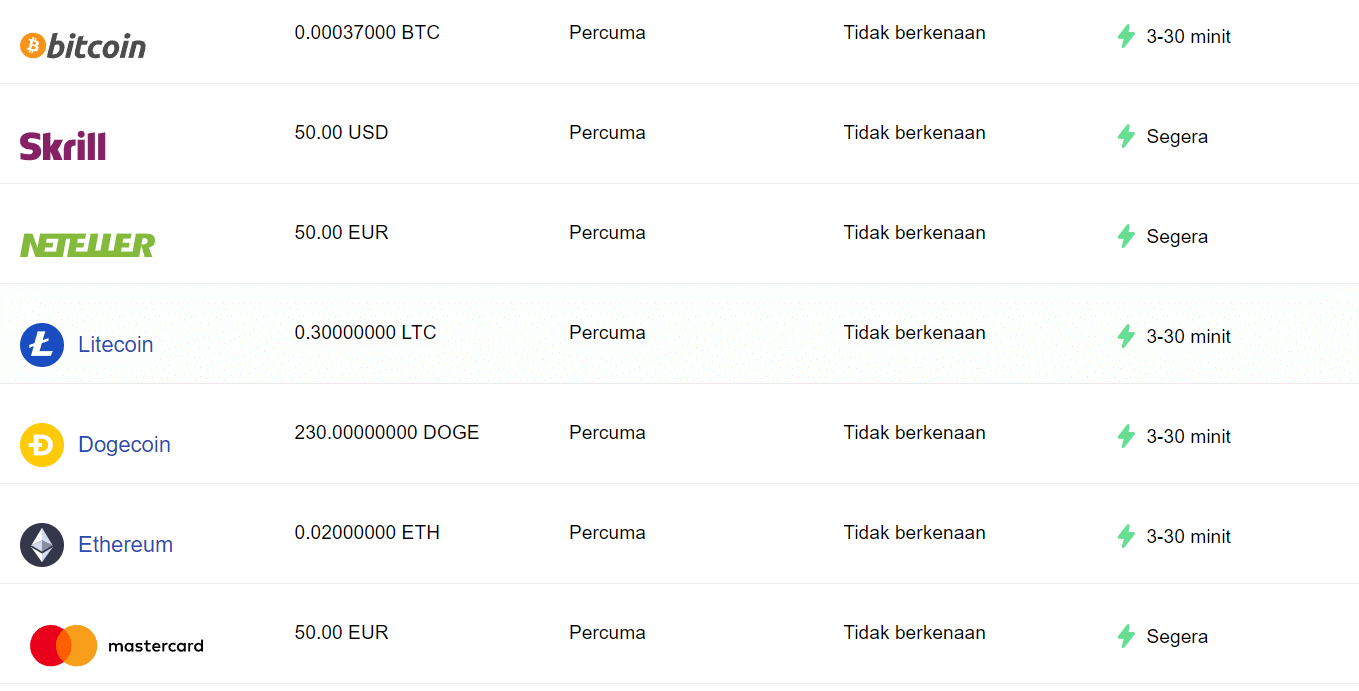

While checking the fees, you should also check the exact fees that your broker will charge you for deposit & withdrawals, and for inactivity.

For example, below is the screenshot from a popular CFD broker’s website, where they mention the fees & minimum for various payment methods.

The broker in the example above does not charge any extra fees when you make a deposit, or during withdrawals via local payment methods. But it is not uncommon for forex brokers to charge fees during withdrawals.

Most forex brokers may not charge you during deposits, in order to encourage you to fund you trading account. But during withdrawals, they would charge you payment gateway fees, currency conversion charges or what not. All these charges can add up & make your trading expensive.

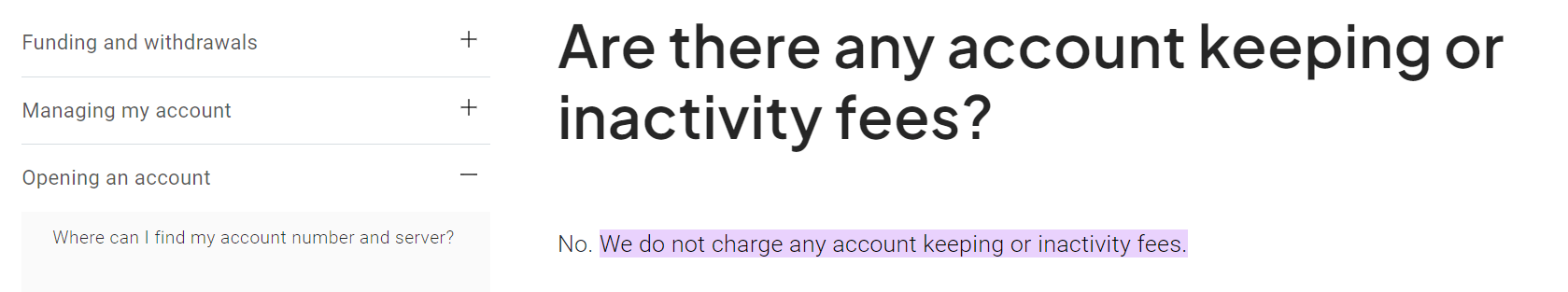

Some brokers even charge you for inactivity. For example, if you have not logged into your trading account for a few days, then your broker would deduct money from your account balance. That is why you should search first or ask your broker if they charge any fees for inactive or dormant trading accounts.

Below is the screenshot from Pepperstone’s website. They clearly state in their FAQs that they don’t charge any fees for inactivity.

But there are many other forex brokers that are not so lenient, and they charge excessive penalties for inactive accounts, all of which will be deducted from your account equity.

4) Trading Conditions: Each forex broker offers different trading conditions. A few factors that a trader should check are trading instruments offered by the broker, the trading platforms available, the different types of trading accounts, the leverage offered, the deposit and withdrawal methods available, and the minimum deposit.

For example, if you want to trade cryptocurrencies, then you should check whether a broker offers CFDs on cryptocurrencies before you sign up with them.

You should also check the exact fees charged with the instrument which you want to trade. If you are only looking to trade majors, then compare the CFD brokers based on their fees for each major pair.

Traders can find the information on the available CFD instruments on the broker’s website. The information is generally made available by the brokers under ‘Markets’ or ‘Trading Instruments’ where they list different asset classes.

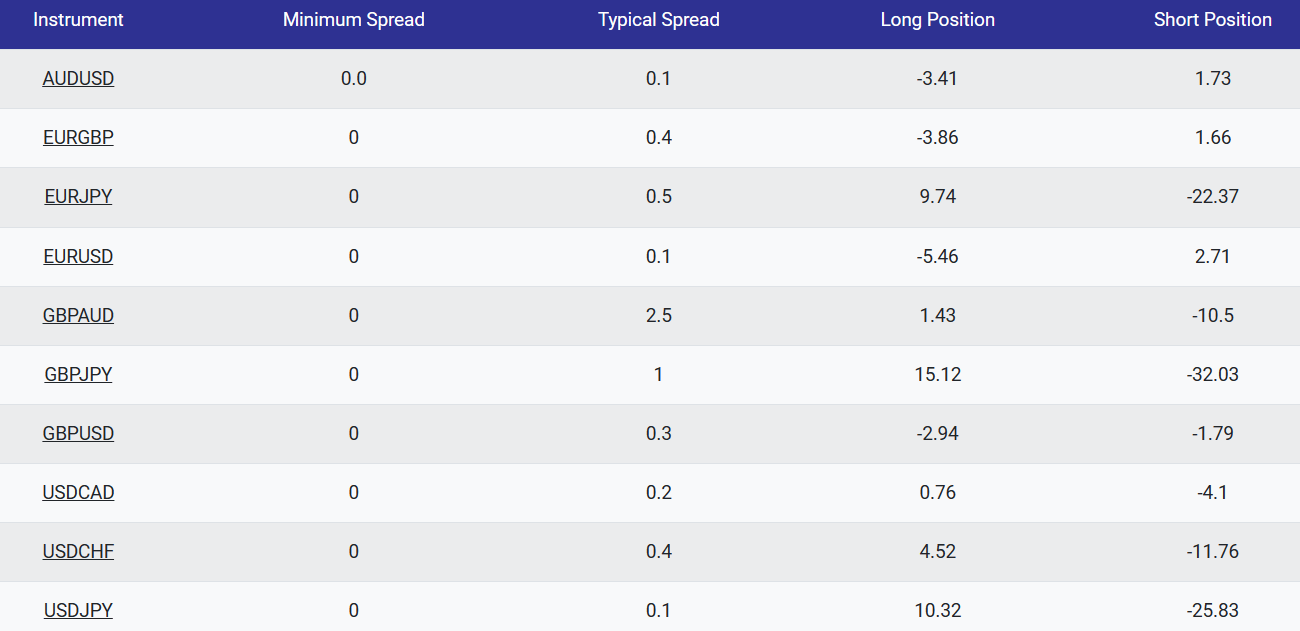

For example, Tickmill list all the forex pairs that they offer, and mention the trading conditions (spreads, swap charges, trading hours etc.) for each instrument.

You will see in the screenshot below, that Tickmill have mentioned that their typical spreads for trading EUR/USD is 0.1 pips. But they did not mention for which account are these spreads valid. They have 3 account types which Malaysia clients can open.

Another important aspect to consider is the account types available. Does the forex broker offer Islamic accounts as well? For example, you should choose the account type by considering your trading volume & instruments.

Let’s say that you mostly trade GBP/USD, and trade 1 Standard lot on average in a day. Such a trader should choose an account with lower spreads, because the fees will be quite high if you are still trading on a Standard or a Cent Account.

For example, if the spreads for GBP/USD with Standard Account were 1.5 pips, then you are paying $15 for trading a Standard Lot. But if your forex broker has a lower commissions account, with 0.1 pips spread & $7 commission for roundturn, then your typical trading charge would be $8 per lot.

In this above example, the Trader trading on a Standard account, would pay very high fees to their forex broker. Therefore, you must consider which trading accounts are being offered by your forex broker, and what are the conditions of contracts for each CFD instrument.

You must also find out whether your forex broker offers negative balance protection or not. This is very important so that you don’t owe any money to your broker in case your account goes into negative.

The above is an example from FxPro. They state in their policies & FAQs, that they offer NBP for retail traders. So, even if your balance goes into negative from some trade, it will be reset back to zero.

That is why you must check the terms carefully before signing up with any forex or CFD broker. There have been incidents in the past where the client accounts with brokers went into negative, and the brokers asked them to pay it.

But the regulators have made it mandatory in most jurisdictions now, that CFD brokers must offer NBP.

5) Language: Even though not every forex broker offers their services in Malay, there are some who do. If you want to avail of brokerage services in Malay, then you need to check which brokers offer such services. You should also check whether their customer support is offered in Malay.

6) Customer Support: It is crucial that a forex broker provide good customer support. Issues with trading can be serious and it can be difficult to navigate the services offered by a broker. To check customer support, read reviews posted online.

You can also get first-hand information by asking a broker’s support team a few test questions. Pay attention to how quickly they respond to your queries and how helpful their response is.

Which Forex Brokers are regulated in Malaysia?

Securities Commission Malaysia is the local regulator, and they have not issued license to any retail forex brokers to accept clients in Malaysia. All the forex brokers that are listed above are not legal in Malaysia.

This guide is only for education. Any trader who is actively trading forex via offshore brokers should be aware of their risks & legality. In case of any issues, the regulatory protection would not be available, since these brokers are unregulated.

The regulator has also warned against these unlicensed forex/derivative brokers dealing in Malaysia, and this list includes all the offshore forex brokers like Octa, HFM, Tickmill etc. By choosing to open account with any of these brokers, you are accepting the risk yourself.

How do Forex Brokers make money?

Forex Brokers charge their clients fees, which can be spreads, commissions per lot on your trading volume, inactivity fees, withdrawal fees.

For all your trading activities, your broker gets a cut from it. Some market maker brokers may even be dealing against you, so for all the losses that you make, your broker earns that money.

But if a forex broker is a non-dealing broker, they would make money from spreads & commission. For example, if Broker A is charging you 1 pip spread for USDCHF, they for every 1 million USD traded (or 10 standard lots), the broker will make USD 100.

Is it Legal to trade Forex through brokers in Malaysia?

No, since none of the foreign forex brokers are regulated under the local jurisdiction in Malaysia. Therefore, it is the responsibility of the trader, and your own risk.

Generally, when you open your real account with any forex broker from Malaysia, you will find that their entity is under offshore jurisdiction. By no means is your account being opened under the oversight of any local regulator, and this creates a counter-party risk.

Most offshore brokers are listed on ‘Investor Alert List’ issued by SC of Malaysia. Therefore, investors are advised to not use any of these brokers for forex trading.

If you do decide to trade forex, remember that it is not legal to do so.

Frequently asked questions: Best Forex Brokers

Which is the Best Forex Broker in Malaysia?

According to our reviews, these 3 forex brokers are the best overall for Malaysian traders based on their overall fees & safety:

Which forex broker has the lowest fees?

Based on the comparison of spread, commissions and other non-trading fees; Hotforex & XM have comparably low fees with their Zero & Ultra Low trading accounts respectively. These low cost forex brokers also don’t charge any fees for deposit or withdrawals.

Which forex brokers have Islamic Account?

As per our research, OctaFX, FXTM, AvaTrade offer Islamic account with low trading fees. There are no extra charges in opening this account type.

Which forex brokers are licensed in Malaysia?

There are no licensed & approved forex brokers in Malaysia that can legally accept retail traders.

All the major forex brokers including the popular ones like OctaFX, XM Broker, HFM, RoboForex that accept retail traders in Malaysia are foreign CFD brokers, and they are not licensed in Malaysia (so they are not operating legally). These CFD brokers are regulated by forex Top-tier regulators like FCA, CySEC & ASIC, but they are not regulated by the local regulators in Malaysia.