Currency Pairs

A currency pair is a quote of two currencies, where the value of the first currency is quoted against the value of the other. The first currency is called the base currency and the second one is called the quote currency.

Currency pairs are written by using the ISO codes of the currencies. An ISO code is a three-letter alphabetic code.

For example, the Euro-US Dollar is written as EURUSD or EUR-USD or EUR/USD. Here the value of a Euro is quoted against the value of a US Dollar.

EURUSD = 1.20 means that a Euro can buy 1.2 US Dollars or you need 1.2 US Dollars to buy a Euro.

All currency pairs that are traded the most and are based on the US Dollar are known as the major pairs. Some of the major pairs are EURUSD, USDJPY( Japanese Yen) and GBPUSD( Great Britain Pound). Apart from the major pairs, there are

minor pairs( pairs that don't include the US Dollar) and exotic pairs( pairs that include the currencies of emerging economies).

Pips

Pip stands for Percentage in Point. It is the unit used to express the change in value between the price quote of a currency pair, in terms of the underlying currency.

For example, consider that the value of EURUSD increases from 1.1000 to 1.1001. This corresponds to an increase of 1 pip.

In some currency pairs like USD/JPY, the second decimal point is 1 pip. For example, if the USDJPY moves from 140.10 to 140.40, it has moved 30 pips. The exact value of the trade will depend, which we will explain more in sections below.

A pip is generally the last decimal place of a price quote. Like, US Dollar related pairs go up to 4 decimal places and so, 1 pip is equivalent to $0.0001.

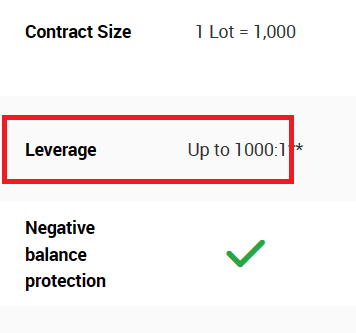

Leverage

Leverage is borrowing a certain amount of money to enter a trade. In the case of forex trading, the amount is usually borrowed from the brokers. Forex traders enjoy the benefit of being able to use higher leverage, unlike any other form

of investment.

The upside of this is that the margin requirement or the amount of money you need to invest initially is really low compared to the capital requirement.

For example, some forex brokers offer up to 1:1000 leverage. This means you can exercise control over a sum of $10,000 by just investing $10 upfront.

But, leverage is a double-edged sword. If the trade doesn't go in your favour, then you'll lose just as much as you could have gained. Ideally, you should trade by calculating the risks involved and the potential losses shouldn't exceed

3% of your capital amount.

Bid and Ask Prices

A forex broker will show you their quote on their platform. The quote has bid price & an ask price.

Bid price is the price at which you can buy a currency pair. For example: If the bid price for EUR/USD is 1.2121, then you can place a buy order at this price.

Similarly, the ask price is the price at which you can sell the currency pair.

The bid price of a currency pair is always lower than the ask price.

Spread Charged by a Forex Broker

A spread is the difference in the bid and ask prices of an asset or security.

The spread of a currency pair depends on the forex pair. It's highest for exotic pairs like SEKZAR and lowest for the major pairs like GBPUSD or EURUSD for example. Spread is measured in pips.

As the value of a forex pair can change based on the market conditions, so can the value of its spread. Thus, spreads are of two types- Fixed spreads and Variable spreads.

Fixed spreads remain the same, irrespective of the market conditions. Fixed spreads are usually offered by brokers who act as "market makers". One advantage of fixed spreads is lower capital requirements. Also, since the spread is fixed,

the prices remain predictable.

For example, AvaTrade Malaysia offers fixed spread trading account. Their spread is 0.9 pips for EUR/USD currency pair.

Variable spreads keep changing based on the market conditions. Variable spreads are mostly offered by non-dealing desk brokers. As the broker can adjust the ask prices based on the current situations, variable spreads eliminate the risks

of requotes. Also, variable spreads promote transparent pricing.

Variable spreads are also called floating spreads. Forex brokers that charge variable spreads will mention their 'typical' or 'average' spreads on their website for different account types. For example, below is the screenshot from XM broker's website, where they mention their lowest spreads for every currency pair with the Ultra Low Trading Account

Similarly, all the forex brokers mention their lowest & typical spreads on their websites.

Forex Lot Sizes

In the forex market, currency pairs are always traded in pre-set amounts - called lots.

Just like pips is the unit used to measure a change in the value of currency pairs, lots are used to measure the quantity of currencies being bought/ sold or exchanged.

Lots come in 4 sizes:

- Standard - 100,000 units

- Mini - 10,000 units

- Micro - 1,000 units

- Nano - 100 units

So, if you are placing a Buy order for 5 Mini Lots, it means that you are buying 50,000 Units of a currency pair.

The exact P&L in your trading account will depend on your lot size. You must understand the concept of lot size to manage your risk in forex trading.

Forex Position Sizing

Your position sizing is related to the number of lots which you are trading. This should depend on your account size & your risk.

For example, if you have $1000 in your trading account with your broker, you should only be trading number of lots suitable for your balance. Let's understand this with a real trade.

If you are using 1:10 leverage, then you can place trades of up to $10,000 with your account balance. This mean that if you are trading EUR/USD, you can buy or sell 1 Mini Lot (or 10,000 units).

For every 1 pip movement, the P&L will be $1. The average volatility of EUR/USD can be 70-100 pips in a day. If you are not using any stop loss, and the trade goes against you, then you would lose $70-100 in a day, which is equivalent of 10% of your account balance.

This brings us to the concept of risk in a single trade. You should adjust your 'Stop Loss' and your position size according to the risk. You must never risk more than 2% on a single trade. This means, if you are trading 1 Mini Lot, you should not have more than 20 pips Stop Loss.

Or, if your stop loss is of 50 pips, then you should adjust your position sizing to trade less number of lots, which would come out to be 4 Micro lots or 4000 units on this trade.