FXTM Malaysia Review 2023

FXTM is a well regulated forex & CFD broker that accepts Malaysian traders. They offer Islamic accounts, wide trading instruments but their fees is higher than other brokers.

FXTM is a market maker broker for forex and CFDs that was founded in 2011. FXTM accepts traders from Malaysia and its website is available in the Malay language.

FXTM is a well-regulated broker and is licensed to operate by reputable financial authorities such as the CySEC of Cyprus, the FCA of the UK, and the FSCA of South Africa.

FXTM offers Islamic accounts, however, traders need to specifically request a swap-free account by contacting FXTM customer support. FXTM offers two primary types of accounts which are Standard Accounts and ECN Accounts. Traders can choose from a total of 7 different types of accounts within these two categories. FXTM also offers demo trading accounts for those who want to practice their trading strategy or learn the ropes of trading.

FCTM broker offers MetaTrader 4 and MetaTrader 5, along with their proprietary trading platform called FXTM Trader.

Traders can choose from a wide variety of instruments that includes 62 currency pairs, and several spot metals CFDs, stock CFDs, and CFDs on commodities, indices, and cryptocurrencies.

In our FXTM review, we checked everything that a Malaysian trader needs to know about FXTM. We cover the pros and cons, fees, trading platforms, customer support, trading instruments, and more.

FXTM Malaysia Pros

- FXTM offers ECN accounts based on STP model. Hence, there is no conflict of interest when you open ECN Account with them.

- They offer MT4, MT5 and their own proprietary trading platform

- FXTM offers Negative Balance Protection to traders in Malaysia

- They are regulated by the Tier- 1 FCA (UK) Financial Authority, Tier-2 CySEC, in addition to other reputable financial authorities. Hence, it is considered safe to trade through them.

- They offer an Islamic account to Malaysian traders.

- They offer a wide variety of currency pairs to trade.

FXTM Malaysia Cons

- FXTM is a market maker when you signup with any of their 3 Standard Trading accounts.

- They charge hidden fees such as a withdrawal fee and inactivity fee.

- They do not have an office in Malaysia.

FXTM Malaysia – A quick look

| 👌 Our verdict on FXTM | #7 Forex Broker in Malaysia |

| 🏦 Broker Name | FXTM Malaysia |

| 💵 Typical EUR/USD Spread | From 1.3 pips (with Standard Account) |

| 📅 Year Founded | 2011 |

| 🌐 Website | https://www.forextime.com/ |

| 💰 FXTM Malaysia Minimum Deposit | $10 |

| ⚙️ Maximum Leverage | 1:2000 |

| ⚖️ FXTM Regulations | FCA, CySEC, FSCA |

| 🛍️ Trading Instruments | 62 currency pairs, and several CFDs on spot metals, stocks, commodities, indices, and cryptocurrencies. |

| 📱 Trading Platforms | MT4, MT5 for desktop, tablet, web & mobile along with FXTM Trader |

Is FXTM Malaysia Regulated?

FXTM is a reputable broker and caters to traders worldwide. The company has been in operation since 2011 and has gotten regulated with multiple market regulators.

FXTM is regulated and licensed by the following financial authorities:

- FXTM is registered with the Cyprus Securities and Exchange Commission (CySEC) under the name ‘ForexTime Ltd.’ – and holds the license number 185/12

- FXTM is registered with the Financial Conduct Authority (FCA) of the UK under the name ‘ForexTime Limited.’ with license number 600475.

- FXTM is registered and licensed by the Financial Sector Development Authority (FSCA) of South Africa under the name ‘ForexTime Ltd.’ and holds the license with FSP no. 46614

In addition to the main entity, a group company of FXTM called Exinity Limited is licensed by the Financial Services Commission of the Republic of Mauritius with the license number C113012295. Exinity UK Limited is licensed by the Financial Conduct Authority (FCA) of the UK and holds license number 777911.

FXTM is considered a safe forex broker for Malaysian traders because they are regulated by a number of highly reputed financial authorities.

FXTM also offers negative balance protection to all traders. Additionally, all client funds are kept in separate bank accounts that are maintained with reputed banks.

FXTM Malaysia Fees

FXTM charges fees that depend on the trading instrument, the timing of the trade, and the type of account held by the trader. Hence, the fees charged my differ considerably.

For this review, we are going to refer to a few benchmark examples that give us an idea of the amount of fees that FXTM charges.

Here is a breakdown of trading & non-trading fees at FXTM Malaysia:

- Tight Variable Spreads with ECN Accounts – FXTM charges a variable or floating spread. This means that the spread depends on the timing of the trade. Additionally, the spread also depends on the instrument being traded and the type of account being used.

For example, the minimum spread charged to a user of the Standard account is 1.3 pips. The typical spread charged for trading the benchmark EURUSD currency pair is 1.9 pips, which is higher than many other brokers.

- No Commission except Under ECN Account – FXTM does not charge any commission from traders using 6 out of the 7 types of accounts offered by FXTM. However, FXTM does charge a commission under the “ECN Account”.

Under the ECN Account, FXTM charges a commission of $2 per lot per side, i.e. $4 per lot in total.

- Deposit and Withdrawal Fees– FXTM does not charge a deposit fee. However, it does charge a withdrawal fee. The withdrawal fee charged by FXTM depends on the mode of withdrawal.

For example, FXTM charges a commission of 1.4% from traders using a Malaysian Online Banking Service to withdraw their funds. - Inactivity Fee after 6 Months – FXTM also charges an inactivity fee. If a trading account is dormant for a period of more than 6 months, then FXTM charges a monthly inactivity of $5 or equivalent.

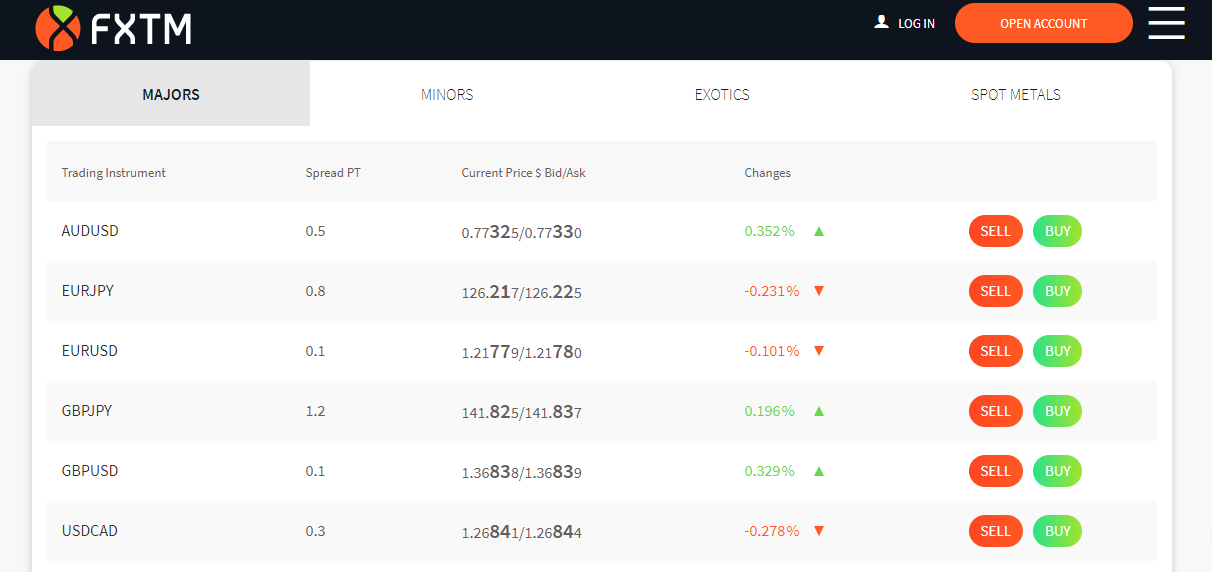

Here is a screenshot of the spread charged for various currency pairs at FXTM.

Overall, we consider the fees charged by FXTM to be average compared to other brokers. However, FXTM charges hidden fees such as a withdrawal fee and an inactivity fee which may be unsuitable for traders.

FXTM Bonus

FXTM offers promotional and bonus offers to make their service more attractive to traders. Currently, there are two promotional offers that are live.

The FXTM Loyalty Program – The FXTM loyalty program gives traders a $5 cashback for every time that they enter into a trade. Traders can earn up to $10,000 through this loyalty program. There are five levels to the loyalty program and a trader is upgraded to a better level based on certain criteria.

Refer a Friend – For each friend that a trader refers, the trader can earn $50. If a friend joins using a referral link, then they also earn $50.

FXTM Deposit and Withdrawal

FXTM offers several ways in which Malaysian traders can deposit and withdraw their funds.

Here is a breakdown of the types of payment methods that can be used.

Local Bank Transfer – Malaysian traders can make a local bank transfer to deposit their funds. The deposit is made instantaneously and will reflect in your account.

Credit Cards – Malaysian traders can also use their credit cards to make a deposit. The credit card providers that are accepted include Visa, Mastercard, and Maestro. The deposit is made instantly.

E-Wallets – FXTM offers several e-wallets that can be used including Skrill, Netteller, Cryptocurrency wallets, WebMoney, and more.

Wire Transfer – FXTM also accepts funds via wire transfer. The processing can take between three to five business days.

The primary drawback is that FXTM does not accept debit cards for payment.

Even though FXTM does not charge a deposit fee, they do charge a withdrawal fee. Remember that a trader may need to pay additional charges that are charged by the payment service provider.

FXTM Account Types

FXTM has two categories of accounts which are Standard and ECN. Under the Standard type, FXTM offers Cent Account, Standard Account, and Stock CFDs Account. Under the ECN type, FXTM offers Stocks Account, ECN Zero Account, ECN Account, and FXTM Pro Account.

The minimum deposit at FXTM Malaysia is $10 with their Cent Account.

All these accounts can be converted into Islamic accounts, except the Stocks Account.

Here is a comparison of the different account types offered by FXTM.

Standard Account – The standard account offers floating leverage from 1:2000. The minimum deposit that has to be made is $100. The spread starts from 1.3 pips.

Cent Account – The Cent account offers fixed leverage between 1:1000 to 1:25 for currency pairs. The minimum deposit is $10. The spread starts from 1.5 pips.

Stock CFDs Account – This account offers fixed leverage of 1:10 for US shares and 1:3 for European shares. The minimum deposit requirement is $100. The spread starts from 0.1 pips.

Stocks Account – Traders can use a leverage of 1:1. The minimum deposit is $100. This account offers tight spreads.

ECN Account – ECN Account users can take advantage of floating leverage from 1:2000. The minimum deposit required is $500. Traders are charged a commission of $2 per lot. The spread starts from 0.1 pips.

ECN Zero Account – The ECN Zero account offers floating leverage from 1:2000. The minimum deposit that needs to be made is $200. Traders are charged a spread starting from 1.5 pips.

FXTM Pro Account – Traders can use floating leverage from 1:2000 to 1:25. The minimum deposit is $25,000. The spread starts from 0 pips.

Overall, FXTM offers a wide selection of accounts for traders to choose. Traders should be careful before picking an account. Each type of account is suitable for a different type of trader.

How to Open Trading Account with FXTM?

To open a trading account with FXTM in 5 steps:

- Visit FXTM’s website.

- Choose an account type.

- Fill out the application with accurate details.

- Verify your identity and submit required documents.

- Deposit funds and start trading once approved.

FXTM Trading Instruments

FXTM offers a large selection of instruments for traders to trade. FXTM provides 62 currency pairs, and several spot metals, stock CFDs, commodities, indices, and cryptocurrencies.

It is worth noting that traders can also access the cryptocurrencies market as CFD through FXTM. The selection of currency pairs is also quite large when compared to other forex brokers. The currency pairs being offered are divided into major, minor, and exotic categories.

FXTM Trading Platforms

FXTM offers traders the option to choose between MetaTrader 4, MetaTrader 5, and its own proprietary trading platform called FXTM Trader.

The MT4 and MT5 trading platforms are popular with traders all around the world. They offer customizable features and are also easy to use. They are available on desktops, web browsers, smartphones, and tablets. The mobile app supports both Android and iOS.

A few of the most attractive features of the MT4 and MT5 platforms include quick order execution, advanced technical analysis features, and trading signals and notifications.

Additionally, the FXTM Trader platform is also a good choice for traders. The FXTM Trader is a mobile app that supports both Android and iOS. It allows you to trade more than 250 instruments. Traders can use the one-click trading function to quickly open and close orders.

FXTM Customer Support

FXTM offers a variety of ways for traders to get in touch with them. Traders can contact them through live chat on their website, email their support team, or call them.

Good Live Chat Support in Malay – We talked to their live chat option while writing this review. They responded to our queries within an average of two minutes. The hold time was also quite low. Their responses were quite helpful. Traders in Malaysia can chat with them in Malay as well.

Dedicated Email – We sent their customer support team an email and they responded within two hours. The response was detailed and helpful. However, they did not respond to all our queries.

Phone Call Hotline – There are no local Malaysian traders who can call. However, they have a customer support hotline based in Mauritius that can be called.

Overall, we found the FXTM customer support to be quite good. They provide quick responses and there are a number of ways to get in touch with them.

Do We Recommend FXTM Malaysia?

Yes, we recommend FXTM for traders based in Malaysia if you are looking to trade with a well-regulated broker, and a bit higher fees are not too big of a concern.

Their website and customer support are available in Malay and they are a well-regulated broker. They offer a good selection of currency pairs for traders. They offer popular trading platforms like the MT4 and MT5 along with their proprietary trading platform FXTM Trader. They also offer several different types of accounts for traders to choose from. Malaysian traders can easily make deposits.

They also offer Islamic accounts that do not charge swap rates or rollover interest.

The main drawback to trading with FXTM is that they charge hidden fees like a withdrawal fee and an inactivity fee. They also do not have a local office in Malaysia.

Overall, we would recommend FXTM to traders who are looking for access to a wide variety of currency pairs.

FAQs on FXTM Review

What is the minimum deposit for FXTM?

The minimum deposit for FXTM is $10 while trading with Cent Account. And with ECN accounts, minimum deposit with Advantage & Advantage Plus account is $100.

Is it safe to trade with FXTM?

FXTM is regulated with top tier regulators FCA, CySEC & FSCA and with other regulators. So we consider FXTM a low risk forex broker and trading with them can be safe.

Is FXTM Regulated in Malaysia?

FXTM is not regulated in Malaysia. But they are regulated with other regulators like FCA in UK, CySEC in Cyprus. So if Malaysian traders choose to trade forex with FXTM, they need to understand the risks involved and do at their own risks.

How to withdraw from FXTM?

Funds withdrawal request can be submitted from the withdrawal page under My Money section. Your withdrawal will be processed to the same method that was used for the deposit.

FXTM Malaysia Kenya