Tickmill Malaysia Review 2023

Tickmill is a reputed forex broker that is licensed with FCA, CySEC & other Top-tier regulations. Their spread with Pro Account is very low, but their support is not the best. See our full Tickmill review for Malaysian traders.

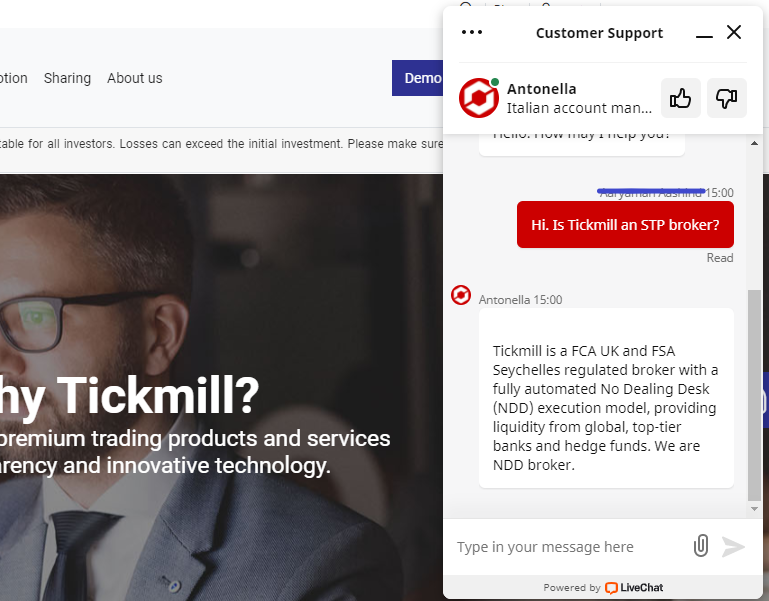

Tickmill is a reputed STP forex & CFD broker that was founded in 2014. Tickmill accepts traders from Malaysia and has a dedicated website in Malay. Tickmill has more than 350,000 registered accounts and has carried out more than $273 million of trade.

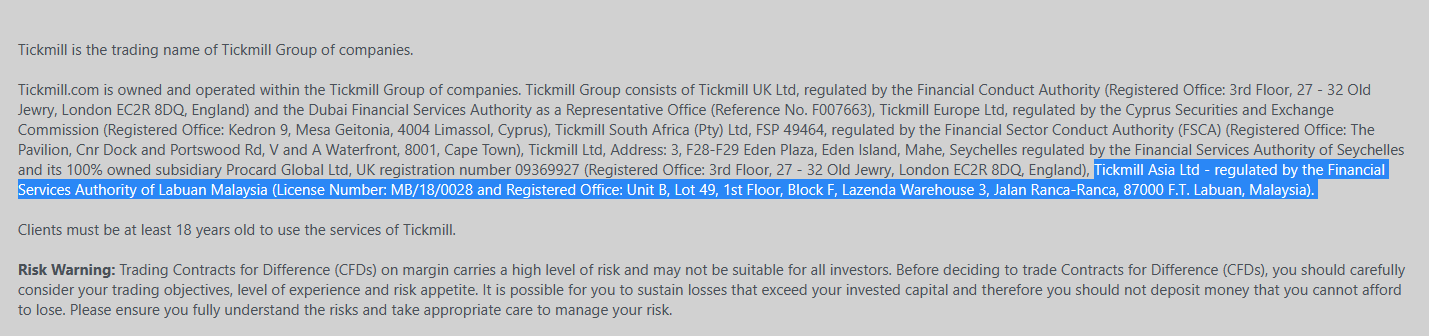

Tickmill is regulated and licensed by the FCA (UK) which is a tier-1 financial regulator. Other financial authorities that have licensed Tickmill include the FSA (Seychelles), CySEC (Cyprus), FSA (Labuan), and FSCA (South Africa). Malaysian traders are regulated by the FSA of Seychelles.

Tickmill offers Islamic accounts for traders in Malaysia. Any classic, Pro, or VIP account can be converted into an Islamic account. Tickmill also offers a demo account for new traders.

Tickmill offers the popular MetaTrader 4 trading platform for traders. The MetaTrader 4 can be used through web browsers, desktops, tablets, and smartphones.

Through Tickmill, traders can access 60+ currency pairs, 14+ stock and oil indices, gold and silver, and 4 bonds.

We looked at Tickmill’s fees, the safety of funds, Malay & English customer support, trading account types, and more.

Tickmill Malaysia Pros

- Tickmill is an STP broker, which means there is no conflict of interest with the clients.

- They do not charge deposit or withdrawal fees on any method.

- Negative Balance Protection is available on Tickmill

- They are licensed by the Tier- 1 FCA, Tier-2 CySEC. So, we considered them a low risk broker.

- Islamic account is available.

- They have a dedicated website for Malaysian traders.

Tickmill Malaysia Cons

- Tickmill only offers MT4 platform.

- They offer a narrow selection of CFDs, however, their offer a high number of currency pairs.

Tickmill Malaysia Summary

| 👌 Our verdict on Tickmill Malaysias | #6 Forex Broker in Malaysia |

| 🏦 Broker Name | Tickmill Malaysia |

| 💵 Typical EUR/USD Spread | 0.1 pips with Pro Account |

| 📅 Founded | 2014 |

| 🌐 Tickmill Malaysia Website | https://www.tickmill.com/ms/ |

| 💰 Tickmill Malaysia Minimum Deposit | $100 |

| ⚙️ Leverage | 1:500 for currency pairs (Max.) |

| ⚖️ Tickmill Regulations | FCA, CySEC, FSA, Labuan FSA, FSCA |

| 🛍️ Trading Instruments | 60+ currency pairs, 14+ stock and oil indices, gold and silver, and 4 bonds |

| 📱 Trading Platforms | MT4 for desktop, tablet, web & mobile |

Is Tickmill Malaysia Regulated?

Tickmill has been in operation since 2014 and is considered a reputable broker. Tickmill is regulated by both Tier-1 and Tier-2 financial authorities.

Tickmill is regulated and licensed by the following financial authorities:

- Tickmill is registered with the Cyprus Securities and Exchange Commission (CySEC) under the name ‘Tickmill Europe Ltd.’ – and holds the license number 278/15

- Tickmill is registered with the Financial Conduct Authority (FCA) of the UK under the name ‘Tickmill UK Ltd.’ with license number FRN 717270.

- Tickmill is registered and licensed by the Seychelles Financial Services Authority (FSA) of Seychelles under the name ‘Tickmill Ltd.’ with license number SD008.

- Tickmill is registered and licensed by the Labuan Financial Services Board (Labuan FSA) of Labuan under the name ‘Tickmill Asia Ltd.’ with license number MB/18/0028.

- Tickmill is registered and licensed by the Financial Sector Development Authority (FSCA) of South Africa under the name ‘Tickmill South Africa (Pty) Ltd.’ with license number FSP 49464.

Tickmill is considered a safe forex broker for Malaysian traders, but they are not locally licensed.

‘Tickmill Asia Ltd’ is licensed with Financial Services Authority of Labuan Malaysia, but local traders are not registered under this regulation during our check.

Malaysian traders come under the jurisdiction of the Seychelles Financial Services Authority (FSA) of Seychelles. Additionally, Tickmill is operated by a number of reputed financial authorities. Tickmill has a strong record of safety and has clients across the globe.

Further, Tickmill also provides negative balance protection for traders in Malaysia. The company also practices segregation of funds and all client funds are kept in a separate account.

Hence, Tickmill is considered to be a safe broker for Malaysian traders.

Tickmill Malaysia Fees

The fees that Tickmill charges depends on the type of account held by the trader, the instrument that is being traded, and the timing of the trade.

For this review, we shall be using benchmark examples as an indicator of the fees charged by Tickmill.

Here is a breakdown of trading & non-trading fees at Tickmill Malaysia:

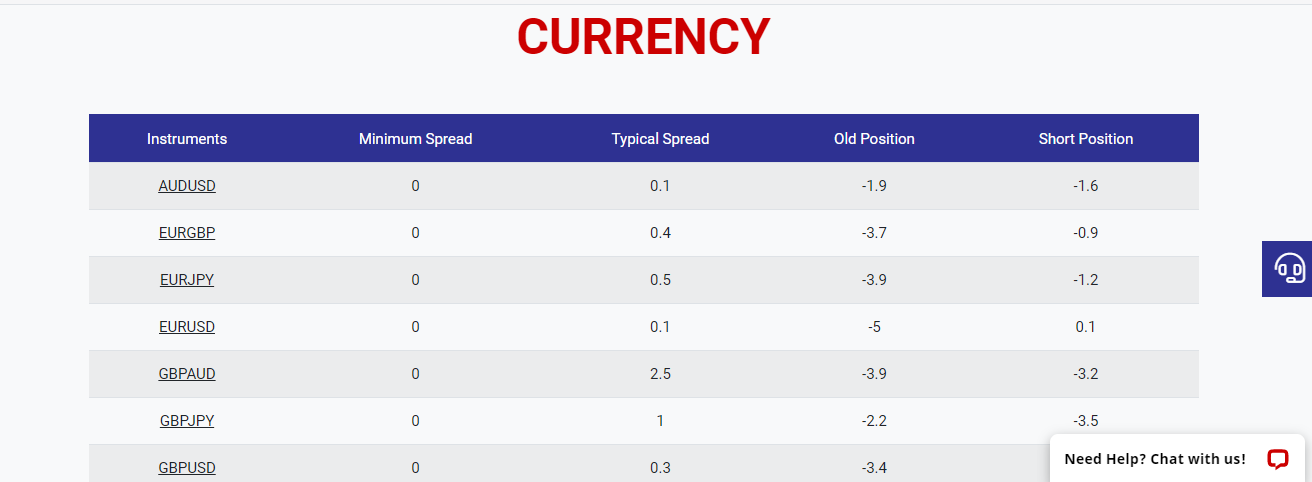

- Low Variable Spreads – Tickmill is a variable spread broker. The amount of spread depends on the market conditions at the time of the trade and the instrument you are trading.

For example, the average spread charged at Tickmill for trading EURUSD currency pair with Pro Account is 0.1 pips while the minimum spread is 0 pips.

- Zero or Fixed Commission – Tickmill does not charge a commission from users of the Classic account. However, a commission is charged under the Pro and VIP accounts.

Pro Account – The commission charged is $2 per side per 100,000 traded.

VIP Account – The commission charged is $1 per side per 100,000 traded.

- Zero Deposit and Withdrawal Fees – Tickmill does not charge any deposit or withdrawal fee. However, users may incur a fee charged by the payment service provider.

It is worth noting that all deposits that are greater than USD 5000 (or equivalent) which are deposited through a bank wire transfer are included in their Zero Fees Policy.

- No Inactivity Fee – Tickmill does not charge any inactivity fee from its users. Hence, users can open an account and leave it dormant without being charged any fee.

Below screenshot shows the typical spread charged by Tickmill for foreex.

Overall, we found Tickmill to be a low-cost broker.

They do not charge any commission under their Classic account and the spread is kept tight. Further, Tickmill does not charge any hidden fees such as deposits, withdrawals, or inactivity fees. Hence, the cost of trading with Tickmill is relatively low-cost compared to other similar brokers.

Tickmill Bonus

Tickmill offers a few bonuses and promotions for traders in Malaysia. Here is a breakdown of the promotional offers that are currently available.

Trader of the Month – Every month, Tickmill provides a bonus of $1000 to the most successful trader of that month. To identify their trader of the month, Tickmill considers the profit that has been made, risk management techniques that were applied, and the money management skills of the trader.

There is no additional registration required to enter the Trader of the Month contest. Every trader who has a live account with Tickmill automatically participates.

Tickmill’s NFP Machine – Winners of this challenge stand the chance to win $500. Every NFP week, Tickmill will choose one instrument and traders will need to guess the trading price of that instrument at 16:00 (which is 30 minutes after the release of the NFP).

The trader who gets the price exactly correct will get a reward of $500. If nobody guesses the exact price, then the trader who made the closest guess will receive $200.

Welcome Bonus – Every new trader who joins Tickmill gets a $30 bonus in his trading account. The trader does not need to make a deposit. Any profit that is made using the $30 bonus can be withdrawn by the trader.

Tickmill Deposit and Withdrawal

Tickmill offers several methods for deposit or withdrawal of funds to traders from Malaysia.

We have done a breakdown of all payment methods available at Tickmill.

Local Bank Transfer – Traders can make a bank transfer to deposit their funds or request a bank transfer to withdraw their funds. The minimum deposit that must be made is $100.

Debit/Credit Cards – Tickmill offers the option to make your deposit through a debit card or a credit card. Tickmill accepts both Visa and Mastercard cards.

Payment Wallets – A variety of payment wallets can be used to deposit or withdraw funds. These options include Skrill, Neteller, Sticpay, Fasapay, Unionpay, NganLuong, and Qiwi.

It should be remembered that Tickmill does not charge any deposit or withdrawal fee. Hence, traders can make as many transfers as they want, subject to the fees charged by the payment processor.

Tickmill Account Types

Tickmill offers three primary types of accounts to their traders. These account types are Classic, Pro, and VIP.

Each type of account can be converted into an Islamic account.

Here are the primary differences between the different types of accounts.

Islamic Account – Tickmill offers Islamic accounts that comply with Sharia law. Hence, they do not charge a rollover interest or swap fee under these accounts. Traders can convert their Classic, Pro, or VIP account into Islamic accounts. The other trading conditions that will be applied to the trading account will depend on whether it is Classic, Pro, or VIP.

Pro Account – Under the Pro account, the minimum deposit is $100. The available base currencies are USD, EUR, and GBP. The commission charged under this type of account is $2 per side per 100,000 traded.

Classic Account – Under the Classic account, the minimum deposit is $100. The available base currencies are USD, EUR, and GBP. No commission is charged from traders using this account.

VIP Account – Under the VIP account, there is no minimum deposit. However, the minimum balance needs to be $50,000. A trader will be charged a commission of $1 per side per 100,000 traded.

Overall, the different kinds of accounts that Tickmill offers are quite simple to understand. The principle difference is the amount of commission that you will be charged. Tickmill also offers a demo account. Traders can use a demo account to practice their trading skills and trading strategies.

Tickmill Trading Instruments

Tickmill offers Malaysian traders the option to trade a wide variety of currency pairs, however, the option for trading other types of CFDs is quite limited.

Overall, Tickmill provides access to 60+ currency pairs, 14+ stock and oil indices, gold and silver, and 4 bonds.

The number of currency pairs offered by Tickmill is larger than other comparable brokers. However, the selection of other types of CFDs is quite narrow. Notably, Tickmill does not offer any cryptocurrencies for trading.

Tickmill Trading Platforms

Tickmill provides users the MetaTrader 4 trading platform. The MetaTrader 4 is a popular trading platform that is used around the world. Several brokers offer MetaTrader to their traders. It is a highly customizable and feature-rich platform.

The MetaTrader 4 is available on web browsers, desktops, smartphones, and tablets. It supports both macOS and Windows for desktops. For smartphones, the MetaTrader 4 mobile app is available on both Android and iOS.

Some of the primary features offered by MetaTrader 4 include quick execution of orders, EA trading facilities, advanced technical analysis capabilities, availability in 39 languages, and trading signals with notifications.

Notably, Tickmill does not offer a proprietary trading platform of its own. It does not provide social trading or copy trading features like some other brokers.

Tickmill Customer Support

Malaysian traders can reach Tickmill customer support in several ways. Tickmill offers customer support through a live chat option on their website, a contact form on their website, dedicated email support, and dedicated phone support.

Live Chat – We used their live chat customer support option while writing this review. We talked to an English language operator and found the responses to be quick and helpful. The hold time was less than one minute on average. The Tickmill live chat customer support is available in Malay.

Email – Malaysian traders can reach out to Tickmill via email. They promise to respond to queries within 24 hours on working days.

Phone Call – Tickmill does not offer a local Malaysian number for traders. However, they do provide an international line. They can be reached from Monday to Friday between 7:00 – 16:00 GMT.

Overall, we are satisfied with the customer support that Tickmill offers. Malaysian traders should be able to resolve their queries without much hassle.

Do We Recommend Tickmill Malaysia?

We do recommend Tickmill for traders considering the fact that they are FCA regulated, but Malaysia based traders are trading & holding funds with them at their own risk. They don’t have a local license to operate in Malaysia & your account will be registered under offshore regulation.

They have a dedicated website for Malaysian users in the Malay language.

They charge low fees compared to other similar brokers and they do not charge any hidden fees. Tickmill is a highly regulated broker and is considered safe to trade with. They offer good customer support which is available in Malay. The MetaTrader 4 trading platform is quite popular among traders worldwide.

Additionally, they offer Islamic accounts that do not charge rollover interest or swap rates.

The primary drawback to using Tickmill is that they do not offer a wide variety of instruments except for forex. CFD traders other than forex traders will not have too many options while trading through them. Further, they do not offer any social trading features that many traders may want.

FAQs on Tickmill Review

How do I withdraw money from Tickmill?

You need to withdraw using the same method used for deposit. There are no charges on withdrawing money from Tickmill. You can login to client panel and fill the withdtawal form.

Is Tickmill a legit forex Broker in Malaysia?

Tickmill is not regulated in Malaysia, so Malaysian traders are trading with them at their own risk. They are regulated with multiple reputed regulators: FCA, FSCA & CySEC. But traders from Malaysia are registered under ‘Tickmill Ltd Seychelles’, which is their offshore regulated broker.

How long does it take to withdraw from Tickmill?

Tickmill process all withdrawal requests within 1 working day. But the time it takes to reach money in your account depends upon your bank policy. Normally bank witthdrawal take 3 to 7 days and withdrawal in debit & credit card take upto 8 days.

What is the minimum deposit for Tickmill?

The minimum deposit for pro and classic account types are $100. And in case of VIP account types the minimum balance is $50,000.

Tickmill Malaysia Kenya