eToro Malaysia Review 2023

eToro is a European CFD broker that accepts Malaysian traders. They have regulation with FCA, ASIC. But their typical spread for forex & other CFDs is quite high. We check all these points in our review

eToro pioneered social trading through its social trading platform OpenBook in 2010. It is a forex & Crypto CFD broker that accepts traders from Malaysia. eToro uses a combination of STP and market maker practices to broker for its clients.

eToro was founded in 2007 and is currently regulated by tier-1 regulators such as the FCA (UK) and the ASIC (Australia). Traders with eToro have the option of using a Basic account and a Premium account. eToro also offers Islamic accounts that do not charge rollover interest and only charges a spread.

eToro offers a proprietary trading platform that is available in desktop, web, and mobile versions. The desktop, web, and mobile trading platforms are offered in Malay for Malaysian users.

eToro offers 52 currency pairs, 18 cryptocurrencies, stocks, indices, and commodities for trading.

In this eToro Malaysia review, we discuss everything a trader needs to know including the pros and cons, fees, trading platforms, regulations, customer support, and more.

eToro Malaysia Pros

- eToro offers a wide variety of instruments to trade

- eToro is highly regulated.

- eToro offers Negative Balance Protection to traders in Malaysia.

- They offer an Islamic account to Malaysian traders.

- Their website is available in the local language for Malaysian traders.

- They offer a proprietary mobile trading platform.

eToro Malaysia Cons

- They do not offer high leverage.

- They charge high fees, including a withdrawal fee and an inactivity fee.

eToro Malaysia Summary

| 👌 Our verdict on eToro | #12 Forex Broker in Malaysia |

| 🏦 Broker Name | eToro Malaysia |

| 💵 Typical EUR/USD Spread at eToro | Starting from 1 pip |

| 📅 Year Founded | 2007 |

| 🌐 eToro Malaysia Website | https://www.etoro.com/ |

| 💰 eToro Malaysia Minimum Deposit | $500 |

| ⚙️ Maximum Leverage | 1:30 for forex trading |

| ⚖️ eToro Regulations | CySEC, FCA, ASIC |

| 🛍️ Trading Instruments | 52 currency pairs, 18 cryptocurrencies, stocks, commodities, and indices |

| 📱 Trading Platforms | Proprietary Trading Platform |

Is eToro Malaysia Regulated?

eToro has been operating since 2007 and has a strong track record. The company is regulated by tier-1 and tier-2 financial authorities.

eToro is regulated and licensed by the following financial authorities:

- eToro is registered with the Financial Conduct Authority (FCA) of the UK under the name ‘eToro (UK) Ltd’ – and holds the license number FRN 583263

- eToro is registered with the Cyprus Securities and Exchange Commission (CySEC) under the name ‘eToro (Europe) Ltd.’ and holds the license number 109/10.

- eToro is registered with the Australian Securities and Investment Commission (ASIC) of Australia under the name ‘eToro AUS Capital Pty Ltd.’ – and holds the license number 491139

eToro is considered a safe forex broker for Malaysian traders.

In addition to being regulated by top-tier financial authorities such as the FCA and the ASIC, eToro has a long and proven history. The company caters to a large volume of clients across the world and has a good reputation.

It may be worth noting that eToro offers negative balance protection which means that a trader’s account balance cannot be negative. Further, in accordance with applicable regulations, eToro maintains all client funds in a separate bank account ensuring their protection.

Hence, we consider eToro to be a safe broker for Malaysian traders.

eToro Malaysia Fees

eToro charges variable fees depending on the trader’s type of account, which instrument is being traded, and the timing of the trade.

Hence, for this review, we will be using benchmark examples to ascertain the type of fees charged by eToro.

Here is a breakdown of trading & non-trading fees at eToro Malaysia:

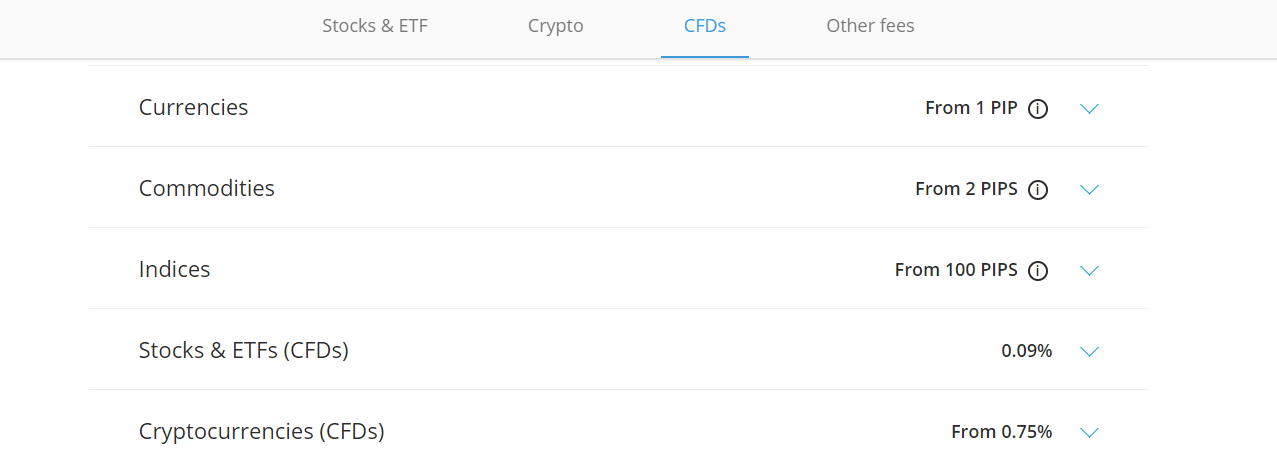

- Variable High Spread – eToro charges a variable spread depending on the instrument and the time of the trade. The benchmark EURUSD currency pair can be traded through the platform at a minimum spread of 1 pip.

Overall, this is a higher spread compared to other similar brokers.

- No Commission for Long Non-Leveraged Trades – eToro does not charge any commission on long trades that are not leveraged. However, the platform does charge a commission if the trader is entering into a short position or is using leverage provided by the platform.

- Deposit and Withdrawal Fee– eToro does not charge any fees on deposits. However, the broker does charge a withdrawal fee of $5 for every withdrawal of funds that is made.

- Charges Inactivity Fee – eToro does charge an inactivity fee of $10 per month if the trader has been inactive for a period of more than a year.

Here is a screenshot of the minimum spread charged for various types of CFDs at eToro.

Overall, we consider eToro to be a high-cost broker since they charge a commission on leveraged trades in addition to a spread. Their non-trading fees are also high since they charge a withdrawal fee as well as an inactivity fee.

eToro Bonus

eToro offers a variety of promotional schemes to its traders. Here is a breakdown of the promotions currently offered by eToro.

Invite a Friend – If a trader refers eToro to a friend who joins the platform, then both the trader and the friend receive a $50 referral bonus.

eToro Partners – eToro runs an affiliate program through which people can earn a commission for promoting the eToro trading platform.

eToro Club – Interested traders can join the eToro Club for a wide range of exclusive benefits. The eToro Club has several tiers which are Silver, Gold, Platinum, Platinum+, and Diamond.

eToro Deposit and Withdrawal

eToro offers a wide variety of ways through which traders in Malaysia can deposit and withdraw their funds.

Credit and Debit Cards – eToro accepts payments through debit and credit cards. Supported cards include Visa, Mastercard, Diners, Visa Electron, and Maestro.

Payment Wallets – Wallets that are supported by eToro include Neteller, Skrill, Rapid Transfer, iDeal, and Klarna. Deposits made through such wallets are completed in an instant.

Online Banking – Traders in Malaysia can use local online banking services to deposit funds. The funds can be deposited in MYR.

The funds can be withdrawn through the aforementioned ways as well, except for users of Rapid Transfer.

Overall, eToro offers convenient ways to deposit and withdraw funds. However, it should be remembered that eToro also charges a withdrawal fee of $5 for every withdrawal.

eToro Account Types

eToro has a relatively streamlined approach to trader accounts. They only offer two tiers for traders to choose from. eToro users have the option of opening a basic account or a professional account.

Additionally, traders can also convert their accounts to Islamic accounts.

Every trader opening an account with eToro is given a basic account. You can choose to apply to convert your account to a professional account.

Traders should remember that a professional account has certain benefits but does not have all the protections that are provided to basic account holders.

Islamic Account – Traders in Malaysia can also convert their account to an Islamic account. Under an Islamic account, traders will not be charged any interest on settlements that are made after 24 hours. There will be no commission charged for a rollover.

In order to convert to an Islamic account, traders will need to invest a minimum amount of $1000. Further, they will need to provide certain documents to verify their identity.

Basic Account – Opening a basic (or retail) account with eToro is quick and easy. The seamless process takes less than 2 minutes and then you can deposit funds to your account and start trading. The minimum deposit for this type of account is $500. Overall, this minimum deposit requirement is much higher than other similar brokers.

Professional Account – To have a professional account with eToro, traders will need to pass a test to determine if they are qualified. Professional traders will be waiving certain benefits that are available to basic traders such as the Investor Compensation Fund and recourse to the Financial Ombudsman Service. However, the professional account gives traders the ability to trade with higher leverage (which comes with higher risk).

Under all types of accounts, eToro also offers social trading services. Under these services, traders can copy trades made by other investors and traders. The investors and traders whose trades are copied earn a commission for every copied trade.

How to Open Account with eToro?

For opening trading account with eToro, you need to follow the below steps:

- Open eToro’s Website: Visit www.etoro.com.

- Sign Up: Click “Sign up” or “Join Now.”

- Select Account Type: Choose Trading or Demo account.

- Fill Registration Form: Enter name, email, and password.

- Verify Your Email: Click verification link in email.

Once done with these steps, you’ll need to complete your profile, upload ID verification, deposit funds, select trading instruments, and start trading.

eToro Trading Instruments

eToro provides Malaysian traders the ability to trade a wide variety of instruments. These instruments include 52 currency pairs, 18 cryptocurrencies, and several stocks, commodities, and indices.

The option to trade cryptocurrencies makes eToro an attractive choice compared to other forex brokers.

In total, with eToro, traders can trade more than 2,000 different financial assets. Traders have the option of using leverage or not using leverage.

eToro Trading Platforms

eToro offers a proprietary trading platform for users to trade through. This proprietary trading platform has been designed to enable social trading. This means that users can copy trades and follow other traders.

Social trading gives users the opportunity to learn from other traders. It also provides greater insight into the market sentiment relating to different instruments.

eToro has a trading community of more than 10 million users, hence traders have the advantage of gaining insight from a large pool of the trading community.

Traders also have the ability to buy into readymade CopyPortfolios.

The trading platform also has a virtual account. Beginner traders can practice trading and hone their investment strategy through this virtual account that does not use real money. Additionally, eToro’s trading platform also offers other features such as TipRanks Research Tab, one-click trading, stop loss, trailing stop loss, procharts, and offline trading.

The trading platform is available on browsers, desktops, and mobile devices. The mobile app is available on both Android and iOS.

eToro Customer Support

There are two primary ways in which traders can get in touch with the customer support team at eToro. Traders can either ‘open a ticket or contact the team through live chat.

eToro’s customer service is available at all times but only on weekdays. eToro does not offer phone support.

Open a Ticket – Traders can send a customer support request through the eToro website. The customer support team will process your request and reach out to you by email within 7 days of your request.

Live Chat – eToro also offers a quicker way for traders to resolve their doubts. The live chat option is available on their website. However, traders will need to open an account with eToro to be able to use the live chat. It is worth noting that the option to open live chat is hidden away in their help center.

eToro also has an extensive frequently asked questions page where users can find answers to common issues.

Overall, we found eToro’s customer support to be average when compared to other brokers.

Do We Recommend eToro Malaysia?

Yes, we recommend eToro to traders based in Malaysia.

The main benefit of using eToro is having access to its social trading features. They have a large community of traders and new and experienced traders alike can benefit from the community. Their copy trading features allow traders to follow more experienced traders.

eToro is a well-regulated broker and is licensed to operate by the top financial regulators in the world. Traders from Malaysia will come under the jurisdiction of the CySEC which is a highly reputable financial authority.

They also offer Islamic accounts that do not charge any rollover interest or swap rates.

Their website and trading platform are both available in the local language of Malaysia.

The primary drawbacks to trading through eToro are the high fees that they charge and the limited leverage options.

FAQs on eToro Review

Is eToro good for beginners?

Yes. eToro is good for beginner as its offer copyTrader feature for begineer with which traders can check and mock the trade of other traders.

FAQs on eToro Review

Is eToro good for beginners?

Yes. eToro is good for a beginner as its offers copyTrader feature for beginners with which traders can check and mock the trade of other traders.

How to withdraw money from eToro Malaysia?

Malaysian Traders can withdraw money by submitting the request under Withdraw Funds section. Clients can request withdrawal to the same payment method that was used for deposits like Credit cards, PayPal or Bank transfers.

What is the minimum deposit for eToro?

The minimum deposit for eToro is $500 when signup using a basic trading account. Traders need to deposit $1000 for an Islamic account.

eToro Malaysia Kenya